Ethereum’s Sudden Crash Explained: The Real Reasons ETH Fell & What Comes Next

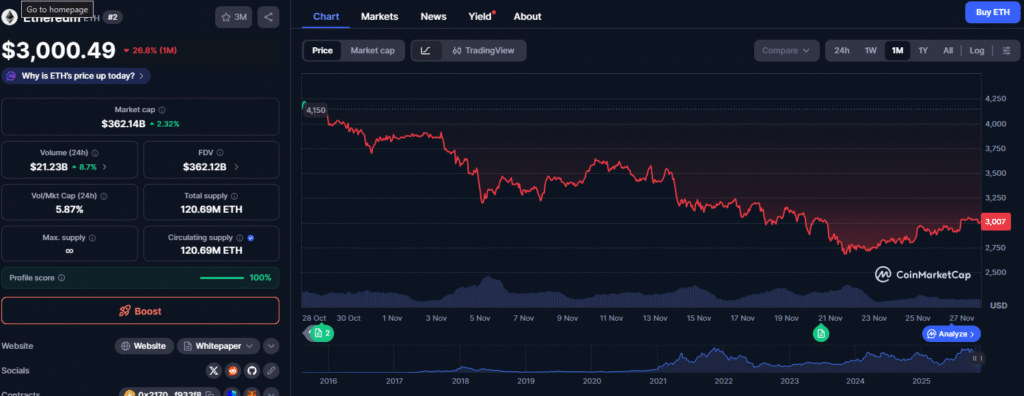

Ethereum was on fire — rallying hard, dominating headlines, and reclaiming its position as the backbone of Web3. Then suddenly, ETH reversed. Prices tumbled, leverage vanished, and fear took over – Ethereum price correction.

So what really caused Ethereum’s sharp crash after touching new highs?

Let’s break down the underlying causes, the market mechanics, and the future outlook for ETH.

💥 1. Leverage Flush: Overheated ETH Market Collapsed Fast

Ethereum’s rally triggered a wave of:

- High-leverage long positions

- Risky derivatives trading

- Overconfident retail momentum

When Bitcoin corrected, the Ethereum market — packed with overextended longs — unraveled.

Billions were liquidated in hours.

This forced selling accelerated the crash, creating a violent downward spiral.

🏛️ 2. ETF Optimism Peaked — Then Profit-Taking Hit Hard

Ethereum’s rally was powered largely by:

- ETF approval hype

- Staking growth

- Layer-2 expansion

But when sentiment peaked, whales and institutions took profits.

Big wallets exited at the top.

This sudden wave of smart-money selling triggered panic among smaller traders, deepening the correction.

⛽ 3. Gas Fees Spiked, On-Chain Congestion Increased

During peak market activity:

- Gas fees soared

- Network congestion slowed down transactions

- Retail users bailed to cheaper chains

High fees create the illusion that Ethereum is “unusable,” which fuels emotional selling even though fundamentals remain strong.

📰 4. Regulatory Headlines Sparked Short-Term Fear

Even mild regulatory uncertainty can tank altcoin markets.

Recent rumors around:

- ETF timelines

- Exchange scrutiny

- Global crypto compliance rules

added pressure to Ethereum right during its most vulnerable moment.

When sentiment is shaky, fear spreads fast.

🧩 5. Liquidity Rotation Back Into Bitcoin

When volatility hits:

- Institutions rotate capital back to BTC

- Traders hedge in Bitcoin

- Risk-on altcoins take the biggest hit

Ethereum often corrects more sharply when Bitcoin dominance rises.

🔮 What’s Next for Ethereum? A Bullish Future Despite the Crash

⭐ 1. Ethereum ETFs Will Bring Institutional Money

Massive inflows are expected as ETFs roll out globally.

This is long-term rocket fuel.

⭐ 2. Layer-2s Are Thriving

Arbitrum, Optimism, Base, zkSync, Blast — the L2 ecosystem is booming.

This strengthens Ethereum, not weakens it.

⭐ 3. ETH Supply Is Becoming Deflationary

Staking + burning = one of the strongest economic models in crypto.

⭐ 4. Developers Aren’t Leaving — They’re Growing

Ethereum still leads Web3 in:

- Developer activity

- DeFi TVL

- Security

- Institutional adoption

⭐ 5. Corrections Are Normal — And Healthy

Every major Ethereum rally has a major reset – Ethereum price correction

This isn’t the end.

It’s a reset before the next wave.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast. Also, read our article on – How the Elon Musk–Donald Trump Feud and Epstein Files Are Quietly Rocking the Crypto Market

Ethereum #ETH #CryptoCrash #CryptoNews #Blockchain #DeFi #Web3 #CryptoMarket #EthereumAnalysis