XRP Overtakes Ethereum: Changed Crypto Power Dynamics

In an unexpected turn of events, XRP has briefly leapfrogged Ethereum in market capitalization—something the crypto space hasn’t seen since 2018. This shift wasn’t a mere price fluctuation; it was a bold statement. XRP’s rise underscores how utility, perception, and regulation are now equally vital in defining a digital asset’s dominance. Is this the predicted XRP Bull Run 2025 or something new?

XRP Surpasses Ethereum: A Record-Breaking Milestone

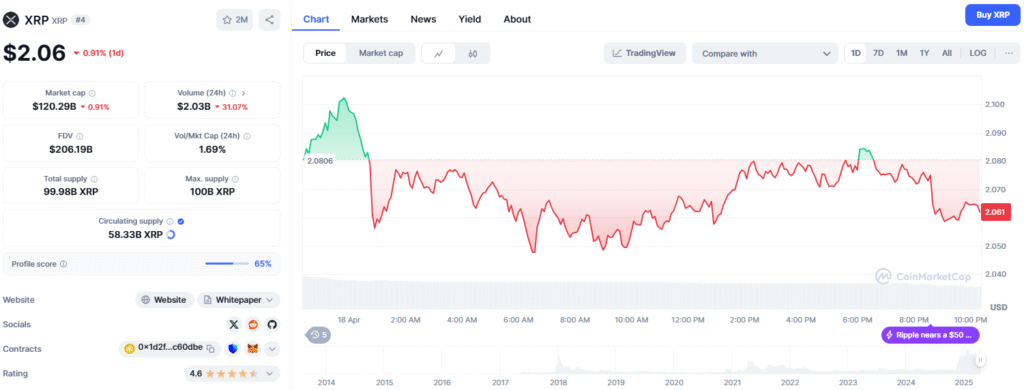

On March 3, 2025, XRP’s market capitalization soared to $272.6 billion, just edging out Ethereum’s $271.6 billion. Though the lead was temporary, its symbolic impact was enormous. For the first time in six years, XRP found itself ranked #2 globally, reigniting debates around the true hierarchy in the crypto world.

Here’s what fueled this resurgence:

- Market Cap: XRP peaked at $272.6B, surpassing ETH’s $271.6B

- Fully Diluted Valuation (FDV): XRP stood at $240B vs Ethereum’s $231.5B

- Price Surge: +460% since the 2024 U.S. Presidential Election

- Institutional Momentum: Massive inflows from institutional players

- Regulatory Clarity: XRP now enjoys clearer status in the U.S.

Institutional Adoption Is Fueling XRP’s Surge

What was once a speculative asset is now being woven into the fabric of traditional finance. Major financial institutions like Société Générale have integrated the XRP Ledger, boosting confidence in Ripple’s technology.

This isn’t just a vote of confidence in XRP—it’s validation of the underlying blockchain infrastructure. When a major European bank uses XRP’s technology, it sends a strong message to institutional investors worldwide: XRP is no longer fringe—it’s foundational.

Regulation: XRP’s Competitive Edge Over Ethereum

While Ethereum’s regulatory status remains under scrutiny, XRP has gained momentum thanks to legal clarity in the U.S. Courts have offered more definition around XRP’s classification, easing concerns and encouraging deeper institutional engagement.

Adding fuel to the fire is the rising demand for XRP ETFs, with heavyweights like Grayscale and Franklin Templeton exploring options. This renewed attention positions XRP as a top contender for regulatory-compliant investment vehicles.

What This Means for the Crypto Landscape: XRP Bull Run 2025

The XRP vs Ethereum comparison is no longer just about technology or price—it’s about strategic relevance. XRP’s integration into banking systems, its legal transparency, and its recent market cap milestone highlight a paradigm shift in investor preferences.

In a world where compliance and utility rule, XRP might just be writing the blueprint for the future of crypto dominance.

🧠 Final Thoughts

Whether XRP can maintain its lead over Ethereum long-term remains to be seen. But one thing is clear: the race for crypto dominance is wide open. As more institutions turn to blockchain solutions that offer both efficiency and legal clarity, XRP is uniquely positioned to lead the charge. from the start of the year, investors have been expecting this year to be the XRP bull run 2025 year.

We may be witnessing the beginning of a new era in digital finance, where the underdog becomes the titan, and where the crypto power structure is redefined by utility, trust, and adaptability.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#XRPvsEthereum #CryptoNews2025 #XRPBullRun2025 #EthereumFlippening #RippleLedger #CryptoRegulation #BlockchainAdoption #XRPETF #AltcoinSeason #DigitalAssets