5 US Stocks to Invest In That Can Help You Beat the Market Index

Beating the S&P 500 is no longer about owning “hot” stocks. It’s about owning businesses with structural advantages — pricing power, strong cash flows, and exposure to long-term growth themes – Best US stocks to invest.

In a market shaped by:

- AI-led productivity shifts

- Higher-for-longer interest rates

- Capital discipline over speculation

Only a small group of companies consistently deliver alpha (returns above the index).

Below are five US stocks with the fundamentals, balance sheets, and growth engines to outperform the broader market over the long term.

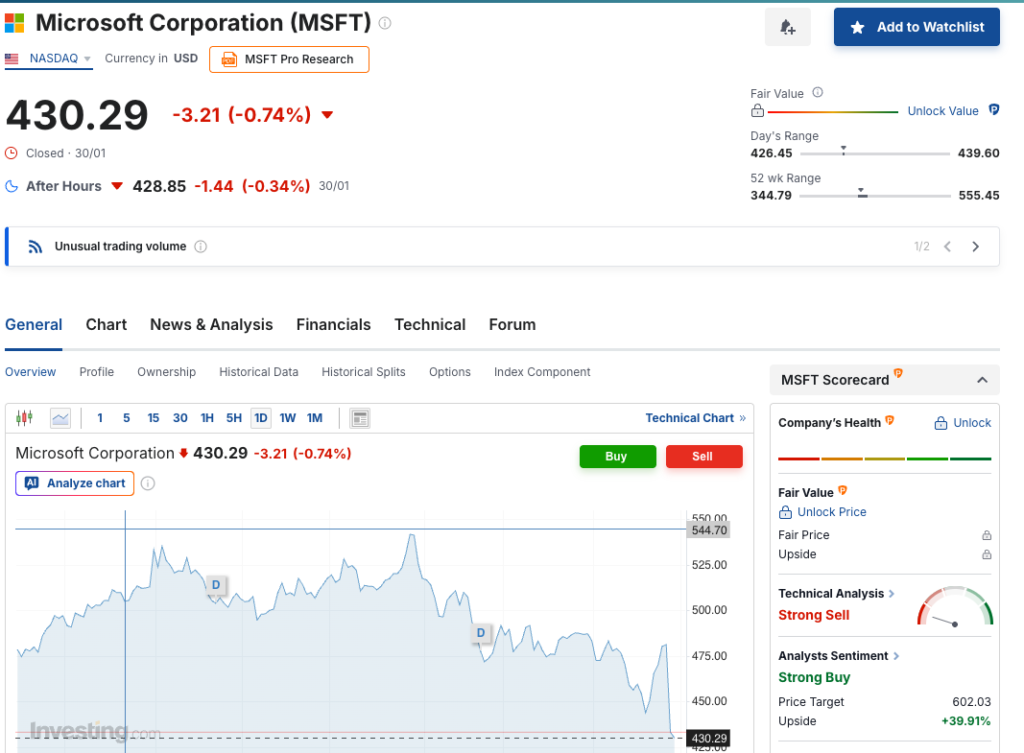

1. Microsoft (MSFT)

Why It Can Beat the Index

Microsoft sits at the intersection of enterprise software, cloud computing, and artificial intelligence — three of the strongest secular trends in the global economy.

Key Strengths

- Dominant Azure cloud platform

- Deep AI integration across Office, Windows, and enterprise tools

- Recurring, high-margin revenue model

- Fortress balance sheet with massive free cash flow

Microsoft doesn’t rely on one product cycle.

It compounds steadily — which is exactly how index-beaters are built.

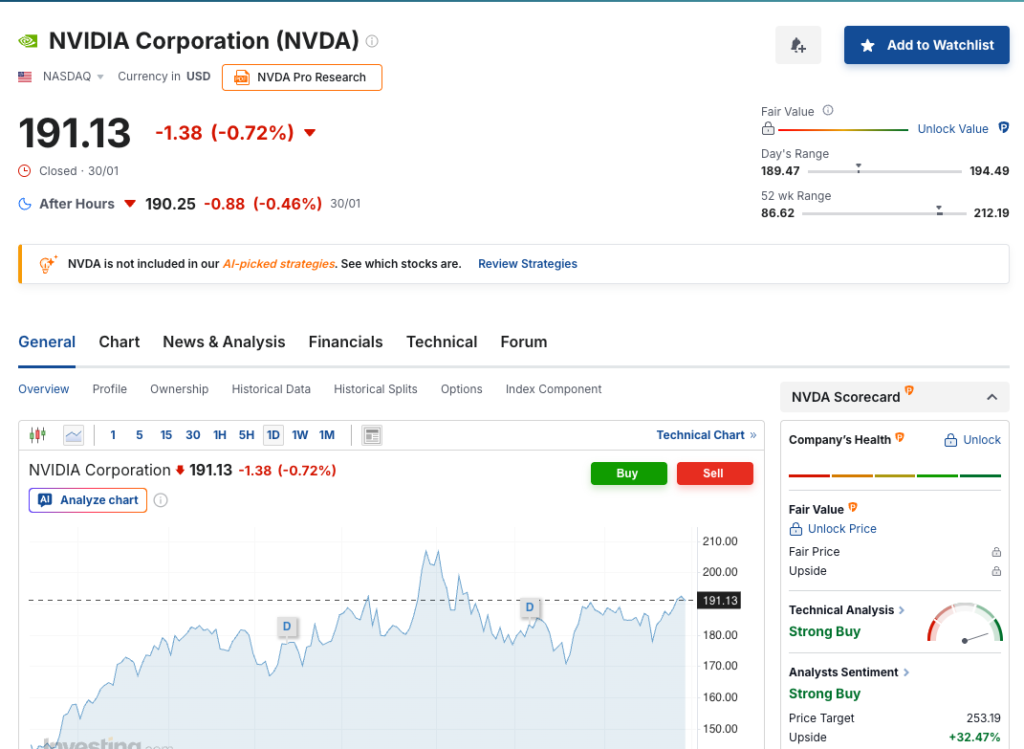

2. NVIDIA (NVDA)

Why It Can Beat the Index

NVIDIA is not just a chipmaker — it is the backbone of the AI economy.

From data centers to autonomous systems, NVIDIA’s GPUs and software ecosystem have become essential infrastructure.

Key Strengths

- Near-monopoly in AI accelerators

- Strong pricing power due to demand-supply imbalance

- Expanding software and platform revenues

- High return on invested capital (ROIC)

While volatility exists, structurally NVIDIA remains one of the highest-growth large-cap stocks in the US market.

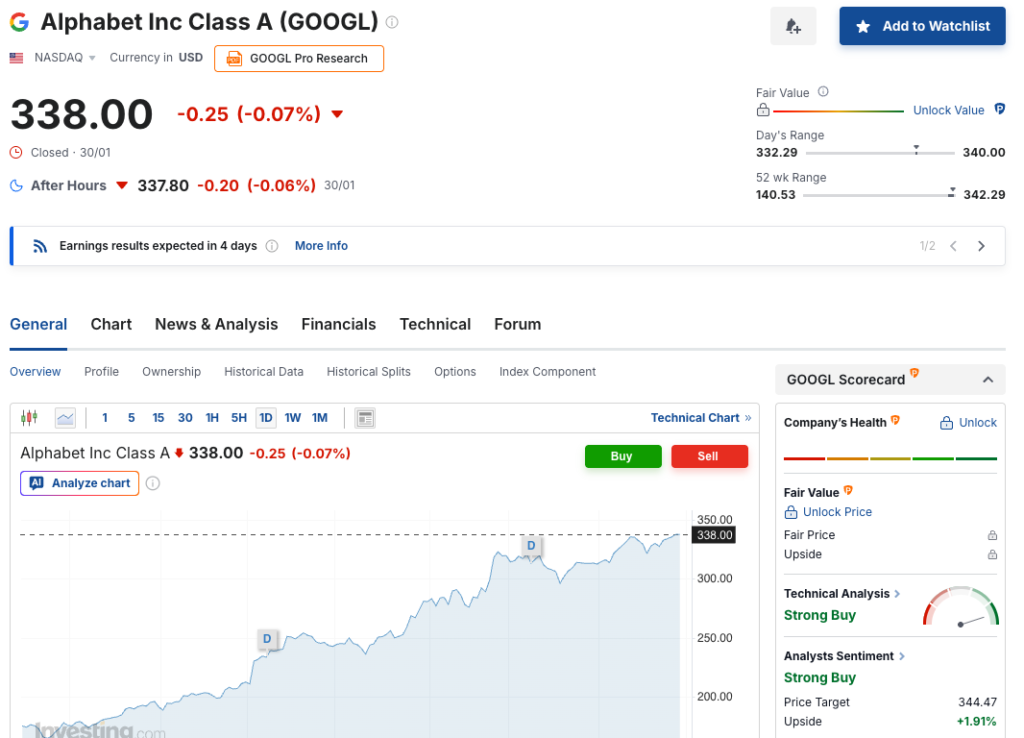

3. Alphabet (GOOGL)

Why It Can Beat the Index

Alphabet combines defensive cash flows with optional growth bets.

Search and YouTube generate enormous free cash flow, while AI, cloud, and autonomous driving provide upside optionality.

Key Strengths

- Global dominance in digital advertising

- Strong AI research capabilities

- Undervalued relative to long-term earnings power

- Massive cash reserves for buybacks and innovation

Alphabet often underperforms in hype cycles — and outperforms over full market cycles.

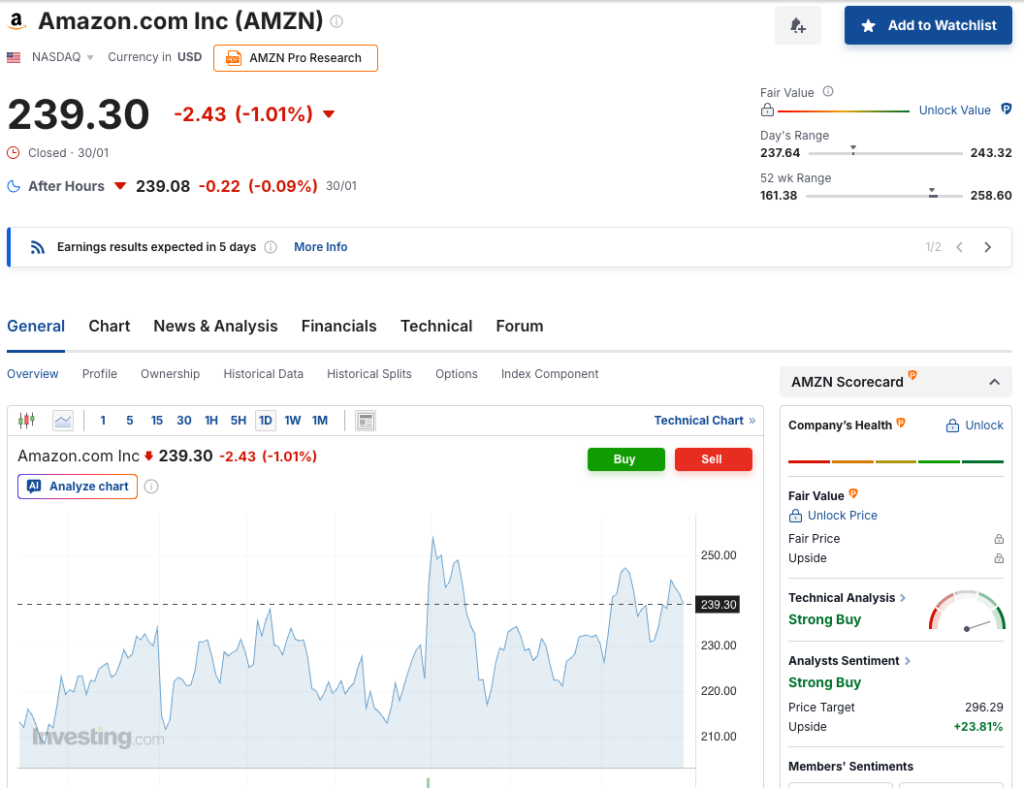

4. Amazon (AMZN)

Why It Can Beat the Index

Amazon is no longer just an e-commerce story.

Its real strength lies in Amazon Web Services (AWS) and logistics efficiency.

Key Strengths

- AWS remains a global cloud leader

- Advertising business growing rapidly

- Improving operating margins

- Long runway in automation and AI-driven retail

As profitability improves, Amazon’s earnings leverage can significantly outperform the index.

5. Visa (V)

Why It Can Beat the Index

Visa benefits from one of the most powerful trends in finance: the global shift from cash to digital payments.

It doesn’t take credit risk — it earns fees on transactions.

Key Strengths

- Extremely high margins

- Global network effect

- Resilient during economic slowdowns

- Consistent dividend growth and buybacks

Visa is a low-volatility compounder, ideal for beating the index with less downside risk.

How These Stocks Beat the Market (Technically Speaking)

These companies share common traits that historically outperform indices:

- Strong free cash flow generation

- High return on equity

- Durable competitive moats

- Exposure to secular growth, not cyclical noise

- Ability to reinvest capital efficiently

Indexes hold everything — winners and laggards.

Selective investing removes the dead weight.

Portfolio Strategy to Maximise Outperformance

A smart approach is core + alpha:

- Core: S&P 500 or broad ETF (stability)

- Alpha layer: High-quality stocks like the five above

Rebalance annually.

Focus on earnings growth, not headlines.

Risks to Watch

Even strong stocks face risks:

- Valuation compression

- Regulatory scrutiny

- Macro slowdowns

Beating the index requires patience, not prediction.

Final Takeaway

You don’t beat the market by trading more- Best US stocks to invest.

You beat it by owning exceptional businesses for long periods.

These five US stocks combine innovation, scale, and financial strength — making them strong candidates to outperform the index over time.

Also read our article on –Scapia vs Niyo Credit Card (2025): Features, Rewards, Fees & Best Choice

#USStocks #StockMarketInvesting #BeatTheIndex #LongTermInvesting #WealthBuilding