Understanding Stocks vs ETFs: A Clear Comparison (Made Simple!)

Understanding Stocks vs ETFs: A Clear Comparison. Let’s be honest: The finance world loves complicated jargon. But today? We’re throwing the jargon out the window and giving you the clearest comparison ever between stocks and ETFs—so you can finally invest with confidence. 🙌 investing for beginners

🔥 What Are Stocks? (The Single-Company Bet)

Imagine putting all your chips on one player in the game.

That’s what buying a stock is.

You own a piece of one company—Apple, Tesla, Amazon, whatever your vibe is.

The upside?

If that company crushes it, your investment can skyrocket.

The downside?

If the company flops… your investment feels the pain.

Like, instantly.

Stocks = High potential, higher risk, zero diversification.

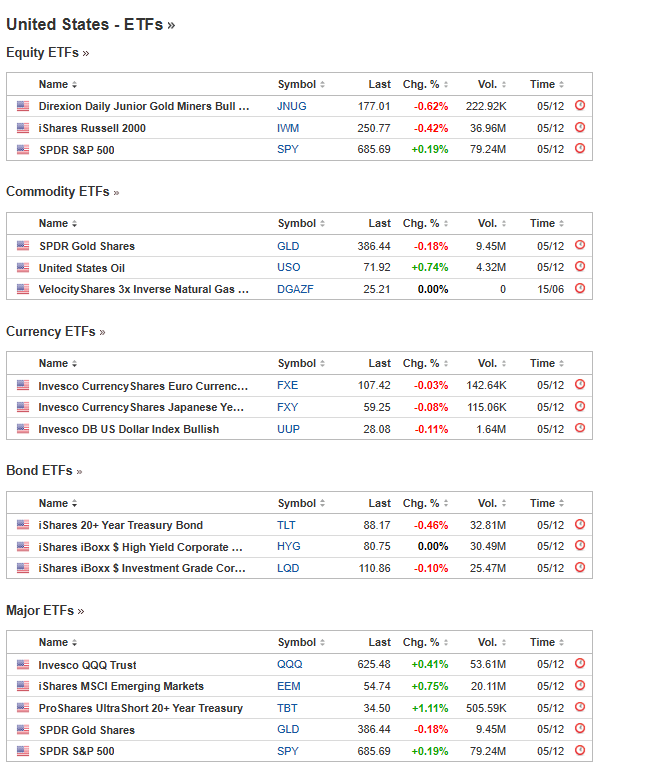

🧺 What Are ETFs? (The Diversified Basket)

Now picture instead placing your chips on the whole team, not just one player.

That’s an ETF.

An Exchange-Traded Fund (ETF) holds lots of stocks (or bonds, or commodities) all at once.

The upside?

If one company falls, others in the basket can balance it out.

The real magic?

ETFs give you instant diversification without needing thousands of dollars.

ETFs = Smart risk-management with steady long-term growth potential.

⚔️ Stocks vs ETFs: The Side-by-Side Breakdown

| Category | Stocks | ETFs |

|---|---|---|

| Diversification | ❌ None | ✅ High |

| Risk Level | Higher | Lower |

| Cost | Often low, but no diversification | Very low (especially index ETFs) |

| Volatility | Can swing wildly | More stable |

| Control | Pick individual companies | Pick entire markets or themes |

| Best For | Active investors, stock pickers | Beginners, long-term investors |

💰 Which One Makes More Money?

Here’s the truth no one wants to say out loud:

👉 Most people make more money with ETFs over the long run

Because they track entire markets that historically rise over time.

Meanwhile…

👉 Most stock pickers underperform

Not because they’re not smart—just because picking winners consistently is insanely difficult.

ETFs aren’t “boring.”

They’re wealth-building machines.

👀 When Stocks Make Sense

Choose stocks if you:

- Love researching companies

- Want bigger swing-for-the-fences opportunities

- Believe strongly in specific businesses

- Don’t mind volatility (aka emotional rollercoasters)

Basically:

If you enjoy being hands-on → stocks might be your jam.

💡 When ETFs Make More Sense

Choose ETFs if you:

- Want simple, reliable growth

- Don’t want to babysit your portfolio

- Prefer built-in diversification

- Value long-term stability

Perfect for beginners. Perfect for busy people. Perfect for sanity.

🎯 The Smartest Strategy? (Hint: You Don’t Have to Choose)

Here’s a pro move:

Use ETFs as your foundation → stable, diversified, long-term

Add a few stocks around the edges → your personal “high conviction” plays

This gives you safety and excitement.

The best of both worlds. 🌍✨

🚀 Final Takeaway

Stocks are like picking your favorite player.

ETFs are like betting on the whole team.

Both can build wealth—

Just in different ways. – investing for beginners

If you want simple, long-term growth with less risk? → ETFs win.

If you want targeted, high-potential bets? → Stocks shine.

Either way, you’re now equipped to invest smarter.

Your future self is already high-fiving you. 🙌💸

Also read our article on –Scapia vs Niyo Credit Card (2025): Features, Rewards, Fees & Best Choice

#investing101 #stocks #ETFs #finance #wealthbuilding #smartmoney #personalfinance

stocks vs ETFs, ETF vs stock comparison, investing for beginners, ETF benefits, stock market basics, diversified investing