Gold Hits All-Time High — Then Cools Off: What’s the Outlook for Gold in 2026?

Gold just reminded the world why it’s called the ultimate safe-haven asset. After a powerful rally that pushed prices to all-time highs, gold saw a brief pullback — not a crash, but a pause. Investors are now asking the big question to invest in gold:

👉 Is gold done for now… or just catching its breath before the next leg higher?

Let’s unpack what really happened and where gold could be headed by 2026.

🟡 Gold’s Record-Breaking Run

Gold’s surge wasn’t hype-driven. It was built on strong foundations.

Several forces came together:

- Persistent global uncertainty

- Central banks buying gold at record levels

- Expectations of lower interest rates

- Rising concerns around inflation and currency stability

As confidence in paper assets wobbled, gold stepped up — crossing historic price levels both globally and in India.

For many investors, gold once again proved its role as a portfolio anchor.

📉 Why Did Gold Pull Back After Crossing Highs?

Gold’s dip wasn’t a signal of weakness — it was a healthy correction.

Here’s why prices cooled off:

Profit Booking

When an asset hits record highs, some investors naturally take profits.

Short-Term Dollar Strength

Temporary strength in global currencies often puts pressure on gold prices.

Market Fatigue

After a long rally, markets tend to consolidate before deciding the next move.

Key takeaway 👉

Gold didn’t lose its story. It simply slowed down.

🔮 Gold Outlook for 2026: Stable, Strategic, and Still Shining

Gold’s future looks less explosive than silver — but far more stable.

🌟 Why Gold Remains Strong for 2026

Central Bank Demand Isn’t Going Away

Many countries continue to increase gold reserves to reduce reliance on fiat currencies.

Rate-Cut Cycles Favor Gold

Lower interest rates reduce the opportunity cost of holding gold.

Geopolitical Insurance

Gold thrives in uncertainty — and global stability remains fragile.

Long-Term Wealth Protection

Gold has historically preserved purchasing power across decades.

Most long-term outlooks point toward gradual appreciation rather than sharp spikes — a sign of maturity, not weakness.

⚠️ What Could Limit Gold’s Upside?

Gold isn’t risk-free.

- Strong equity bull markets can divert capital

- Sudden rate hikes could cap gains

- Short-term volatility will continue

But unlike speculative assets, gold rarely collapses — it consolidates.

How Investors Typically Use Gold

Gold plays a different role than stocks or crypto.

It’s not about quick returns. It’s about stability.

Common approaches include:

- Physical gold for long-term holding

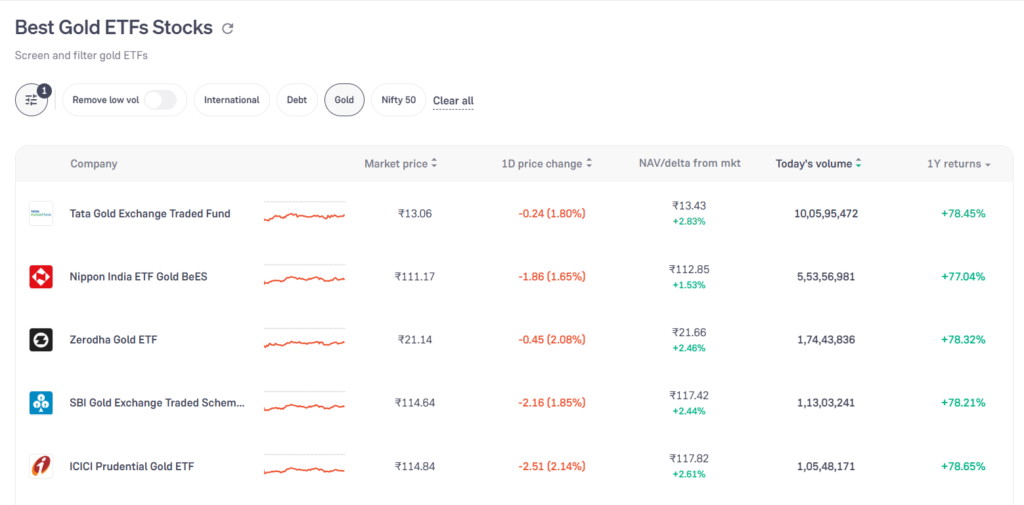

- Gold ETFs for liquidity and ease

- Digital gold for flexibility

- Sovereign bonds for disciplined accumulation

Most experts suggest gold works best as 10–20% of a diversified portfolio. You can buy gold physically, ETF, Futures or Digital Gold

🧠 Smart Gold Strategy Going Into 2026

Instead of timing the top or bottom:

✔️ Accumulate gradually

✔️ Buy during corrections

✔️ Avoid emotional decisions near record highs

✔️ Think in years, not weeks

Gold rewards patience — not panic.

✨ Final Take

Gold’s recent pullback doesn’t change the big picture to invest in gold.

It has:

- Crossed historic levels

- Reinforced its safe-haven status

- Maintained strong long-term demand

As we head toward 2026, gold looks less like a trade and more like an insurance policy.

It may not always be exciting —

but when markets shake, gold still shines.

Also, read our other article Smart Money Moves in Your 40s: 5 Intelligent Investment Strategies to Secure Your Financial Future

Check out more article on Finance on our Finance Category section.

#GoldPrice #GoldInvestment #SafeHaven #PreciousMetals #MarketOutlook #WealthProtection

Gold price today, gold all time high, gold outlook 2026, invest in gold, gold safe haven, gold market analysis, precious metals