Gold and Silver Crash Hard After Record Highs: Technical Breakdown, Key Reasons, and Market Outlook

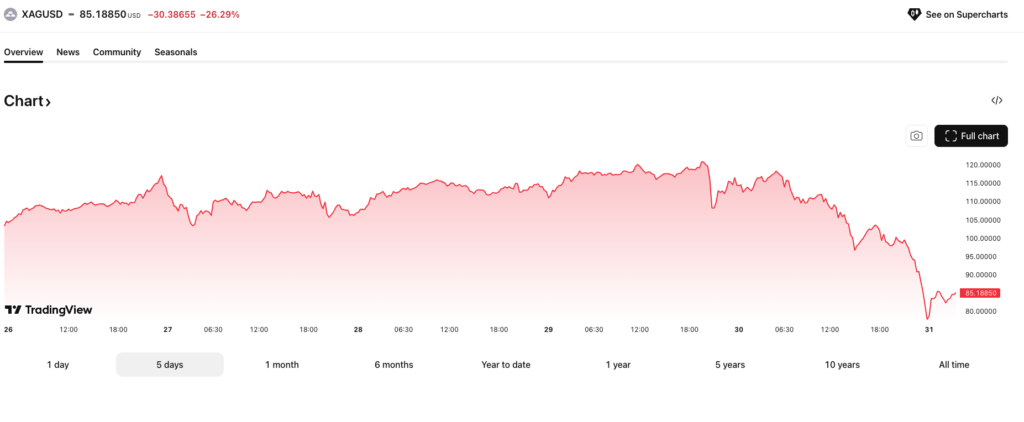

After hitting all-time highs on January 28, gold and silver suffered a sharp, synchronized selloff on January 30, 2026, wiping out days of gains in a single session. Lets take a look at the Silver selloff analysis.

This was not a random shakeout.

It was the unwinding of an overstretched rally, driven by technical exhaustion, positioning imbalance, and macro catalysts aligning at once.

Let’s break this down with precision.

📊 Market Recap: What the Charts Really Show

Gold

- Rejected aggressively at psychological all-time-high resistance

- Printed a bearish engulfing candle on the daily timeframe

- Closed below short-term momentum support

Silver

- Fell faster and deeper than gold

- Broke below intraday VWAP and short-term trend channels

- Volume spiked to multi-week highs, confirming forced liquidation

This was not light selling — it was high-conviction distribution.

🧠 Key Technical & Structural Reasons Behind the Crash

1️⃣ Extreme Overbought Conditions Triggered Mean Reversion

Gold and silver entered statistically stretched territory:

- Daily RSI above 80 (gold) and 85 (silver)

- Price trading far above 20-day, 50-day, and even 100-day moving averages

- Momentum divergence forming on lower timeframes

Markets don’t move in straight lines forever.

Once momentum slowed, mean reversion became inevitable.

2️⃣ All-Time Highs Attracted Institutional Supply

All-time highs are liquidity zones, not comfort zones.

At record levels:

- Long-term holders scale out

- Funds rebalance exposure

- Options writers hedge aggressively

On January 30, sell orders absorbed breakout buyers, creating a failed continuation pattern — often one of the strongest reversal signals in technical analysis.

3️⃣ Futures Positioning Was Excessively Crowded

CFTC-style positioning (futures & derivatives behavior) showed:

- Heavily skewed long exposure

- Rising leverage among short-term traders

- Tight stop-loss clustering just below breakout levels

Once price slipped:

- Stops triggered

- Margin calls followed

- Selling cascaded mechanically

This is how order-flow-driven crashes begin.

4️⃣ U.S. Dollar & Bond Yields Sparked Algo Selling

Even a modest bounce in:

- U.S. Dollar Index

- Treasury yields

was enough to:

- Flip algorithmic correlations

- Trigger systematic selling in metals

- Accelerate downside momentum

Gold doesn’t need a strong dollar to fall — just a less weak one.

5️⃣ Silver’s High Beta Magnified the Damage

Silver carries:

- Higher industrial exposure

- Lower liquidity depth

- Greater leverage participation

Once gold cracked, silver:

- Lost support faster

- Triggered deeper liquidation

- Overshot fair value on the downside

Silver rarely corrects gently — it flushes.

📉 Breakdown of Key Technical Levels

🟡 Gold — Critical Zones

- Immediate support: Prior breakout base

- Structural support: 50-day moving average

- Trend invalidation: Daily close below rising medium-term trendline

As long as gold holds above its base structure, this move remains a corrective reset, not a bear market signal.

⚪ Silver — Volatility Warning

- Short-term risk: Below VWAP and prior impulse low

- Major demand zone: Previous consolidation range

- Stability signal: Compression + declining volume

Silver needs time to rebuild value, not aggressive dip-buying.

🔮 Forward Outlook: What Happens Next?

📌 Short-Term (1–3 Weeks)

- Elevated volatility

- Sharp intraday swings

- False breakouts likely

This is a trader’s market, not a comfort zone for new investors.

📌 Medium-Term (1–3 Months)

Two scenarios dominate:

Bullish Base Case

- Price consolidates

- Momentum resets

- Trend resumes gradually

Neutral Case

- Sideways range

- Capital rotates

- Metals pause while macros evolve

A clean base matters more than speed.

📌 Long-Term Structural View

The long-term thesis remains intact:

- Currency debasement risk

- Central bank diversification

- Geopolitical instability

- Inflation uncertainty

But even strong trends need cooling phases.

⚠️ Strategic Takeaways for Investors

✔ Avoid chasing rebounds

✔ Wait for confirmation, not hope

✔ Use scaling strategies

✔ Respect volatility and position size

Markets punish impatience more than wrong opinions.

fter hitting all-time highs on January 28, gold and silver suffered a sharp, synchronized selloff on January 30, 2026, wiping out days of gains in a single session.

This was not a random shakeout.

It was the unwinding of an overstretched rally, driven by technical exhaustion, positioning imbalance, and macro catalysts aligning at once.

Let’s break this down with precision.

📊 Market Recap: What the Charts Really Show

Gold

- Rejected aggressively at psychological all-time-high resistance

- Printed a bearish engulfing candle on the daily timeframe

- Closed below short-term momentum support

Silver

- Fell faster and deeper than gold

- Broke below intraday VWAP and short-term trend channels

- Volume spiked to multi-week highs, confirming forced liquidation

This was not light selling — it was high-conviction distribution.

🧠 Key Technical & Structural Reasons Behind the Crash

1️⃣ Extreme Overbought Conditions Triggered Mean Reversion

Gold and silver entered statistically stretched territory:

- Daily RSI above 80 (gold) and 85 (silver)

- Price trading far above 20-day, 50-day, and even 100-day moving averages

- Momentum divergence forming on lower timeframes

Markets don’t move in straight lines forever.

Once momentum slowed, mean reversion became inevitable.

2️⃣ All-Time Highs Attracted Institutional Supply

All-time highs are liquidity zones, not comfort zones.

At record levels:

- Long-term holders scale out

- Funds rebalance exposure

- Options writers hedge aggressively

On January 30, sell orders absorbed breakout buyers, creating a failed continuation pattern — often one of the strongest reversal signals in technical analysis.

3️⃣ Futures Positioning Was Excessively Crowded

CFTC-style positioning (futures & derivatives behavior) showed:

- Heavily skewed long exposure

- Rising leverage among short-term traders

- Tight stop-loss clustering just below breakout levels

Once price slipped:

- Stops triggered

- Margin calls followed

- Selling cascaded mechanically

This is how order-flow-driven crashes begin.

4️⃣ U.S. Dollar & Bond Yields Sparked Algo Selling

Even a modest bounce in:

- U.S. Dollar Index

- Treasury yields

was enough to:

- Flip algorithmic correlations

- Trigger systematic selling in metals

- Accelerate downside momentum

Gold doesn’t need a strong dollar to fall — just a less weak one.

5️⃣ Silver’s High Beta Magnified the Damage

Silver carries:

- Higher industrial exposure

- Lower liquidity depth

- Greater leverage participation

Once gold cracked, silver:

- Lost support faster

- Triggered deeper liquidation

- Overshot fair value on the downside

Silver rarely corrects gently — it flushes.

Breakdown of Key Technical Levels

🟡 Gold — Critical Zones

- Immediate support: Prior breakout base

- Structural support: 50-day moving average

- Trend invalidation: Daily close below rising medium-term trendline

As long as gold holds above its base structure, this move remains a corrective reset, not a bear market signal.

⚪ Silver — Volatility Warning

- Short-term risk: Below VWAP and prior impulse low

- Major demand zone: Previous consolidation range

- Stability signal: Compression + declining volume

Silver needs time to rebuild value, not aggressive dip-buying.

Forward Outlook: What Happens Next?

📌 Short-Term (1–3 Weeks)

- Elevated volatility

- Sharp intraday swings

- False breakouts likely

This is a trader’s market, not a comfort zone for new investors.

📌 Medium-Term (1–3 Months)

Two scenarios dominate:

Bullish Base Case

- Price consolidates

- Momentum resets

- Trend resumes gradually

Neutral Case

- Sideways range

- Capital rotates

- Metals pause while macros evolve

A clean base matters more than speed.

📌 Long-Term Structural View

The long-term thesis remains intact:

- Currency debasement risk

- Central bank diversification

- Geopolitical instability

- Inflation uncertainty

But even strong trends need cooling phases.

Strategic Takeaways for Investors

✔ Avoid chasing rebounds

✔ Wait for confirmation, not hope

✔ Use scaling strategies

✔ Respect volatility and position size

Markets punish impatience more than wrong opinions. Silver selloff analysis

Also, read our other article Smart Money Moves in Your 40s: 5 Intelligent Investment Strategies to Secure Your Financial Future

Check out more article on Finance on our Finance Category section.

#GoldAnalysis #SilverCrash #TechnicalMarkets #PreciousMetals #MarketVolatility #TradingPsychology