Solana’s 30% Crash: What’s Behind the Plunge & Can It Recover?

What’s happening with Solana?🤔

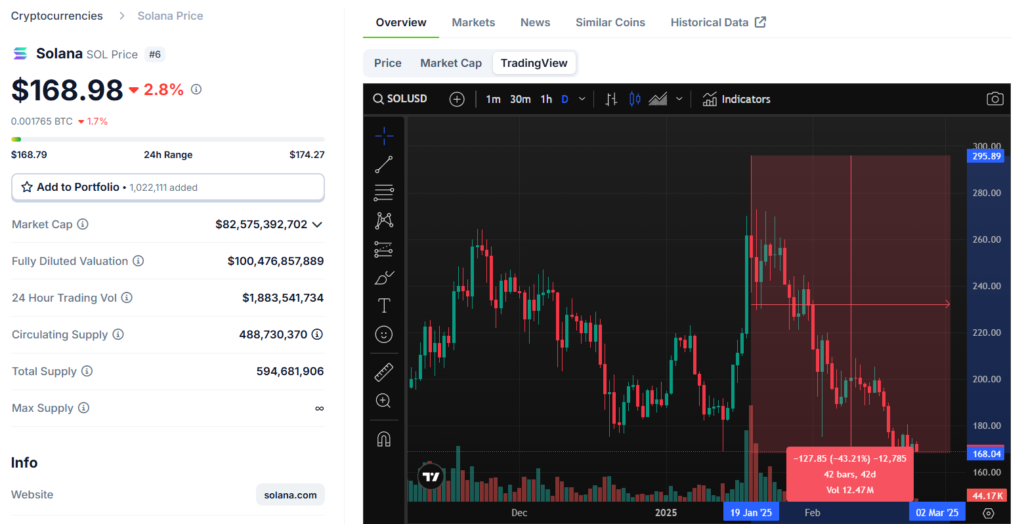

Solana (SOL) has experienced a significant downturn, plummeting over 30% in the past month and more than 10% in the last week alone. This sharp decline positions SOL as one of the poorest performers among the top ten cryptocurrencies, erasing much of the gains accumulated over the previous six months.

Despite this bearish trend, enthusiasm within the Solana ecosystem remains evident. Notably, Solax, the network’s inaugural layer-2 token, successfully raised $22 million in a recent presale event, signaling continued investor interest in Solana-based projects.

Factors Behind Solana’s Decline⚠️

Several key issues have contributed to SOL’s recent price drop:

- LIBRA Meme Coin Scandal: The LIBRA meme coin, heavily promoted by Argentine President Javier Milei, collapsed disastrously, leading to significant financial losses for investors and political fallout. This event has cast a shadow over the broader cryptocurrency market, including Solana.

- Proliferation of Meme Coins on Solana: Solana’s blockchain has become a hotspot for meme coin launches, facilitated by platforms like Pump.Fun. While this has increased activity, it has also led to network saturation and reputational challenges, as many of these coins are associated with speculative trading and scams.

- Market Consolidation: The cryptocurrency market is currently in a consolidation phase, with major assets like Bitcoin and Ethereum struggling to break key resistance levels. This stagnation affects altcoins like Solana, contributing to its price decline.

More Reasons for Solana’s Price Drop📝

- High Exposure to Meme Coins & Speculative Trading

- Solana has become a hub for meme coin launches, fueled by platforms like Pump.Fun. While this has driven short-term activity, it has also brought instability and a surge in scams. Many investors who got burned in these schemes are now pulling back, creating a negative sentiment around the network.

- Network Congestion & Spam Transactions

- The influx of low-quality meme coins has led to network congestion, slowing down transactions and increasing failure rates. Traders and developers are growing frustrated with these inefficiencies, which could impact Solana’s long-term adoption.

- Declining Institutional Interest

- Institutional investors who previously supported Solana have been shifting toward Ethereum and Bitcoin due to concerns over security, volatility, and regulatory uncertainty. A lack of institutional backing makes it harder for SOL to sustain high price levels.

- Profit-Taking by Early Investors

- After SOL’s impressive run in late 2024, many early investors and whales have been cashing out, further driving the price down. This sell-off has contributed to downward pressure, especially with weak buying volume.

- Regulatory Uncertainty

- The crypto market is facing increasing regulatory scrutiny, with lawmakers targeting meme coin scams and unregistered securities. Since Solana has been at the center of the meme coin craze, it could be on regulators’ radar, making investors hesitant.

Solana’s Future: Will It Recover?🚀

✅ Potential for a Comeback:

- Strong Developer Ecosystem: Solana still boasts one of the fastest-growing developer communities, with promising projects in DeFi, gaming, and NFTs.

- Institutional Partnerships: If Solana can regain trust and attract institutional investors, it may see a strong rebound.

- Layer-2 Solutions & Upgrades: The launch of Solax and other scaling solutions could improve network efficiency and restore confidence.

⚠️ Challenges Ahead:

- Solana needs to distance itself from low-quality meme coins and focus on high-value projects.

- The broader crypto market must break out of its consolidation phase for SOL to rally.

- Regulatory developments could impact investor sentiment.

Technical Analysis and Future Outlook

From a technical standpoint, Solana exhibits bearish indicators. The Relative Strength Index (RSI) stands at 46, suggesting the asset is nearing oversold conditions. Additionally, the Moving Average Convergence Divergence (MACD) line has crossed below the signal line, confirming a bearish reversal.

Given the current lack of positive catalysts, SOL is likely to hover around the $170 price level in the near term. Investors should exercise caution and stay informed about market developments before making investment decisions.

Final Verdict:

Solana’s short-term outlook remains bearish, but long-term recovery is possible if the ecosystem evolves beyond speculative trading and delivers real-world use cases.

Read more updates and articles on our Crypto category page

#Solana #CryptoCrash #SOL #Blockchain #CryptoNews #Bitcoin #Ethereum #MemeCoins #Investing #Web3

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.