Best Investment Opportunities in 2026: A Smart, Diversified Strategy for Changing Markets

2026 is not about chasing quick wins. It’s about balancing growth, stability, and protection (Best investments 2026).

Markets are adjusting to:

- Slower global growth

- Higher-for-longer interest rates

- Geopolitical uncertainty

- Rapid technological change

In this environment, the best strategy isn’t betting on one asset — it’s diversification done right.

Below are the best investment opportunities for 2026, explained simply and practically.

1. Equities (Stocks): Focus on Quality, Not Hype

Stocks remain essential for long-term wealth creation, but 2026 favors strong fundamentals over speculation.

Best Areas to Focus On

- Large-cap companies with stable earnings

- Businesses with pricing power and low debt

- Sectors tied to long-term demand, not trends

Key Themes

- Artificial intelligence infrastructure

- Healthcare and biotechnology

- Energy transition and utilities

- Defense and cybersecurity

Why stocks still matter:

Even in volatile years, quality equities outperform inflation over time.

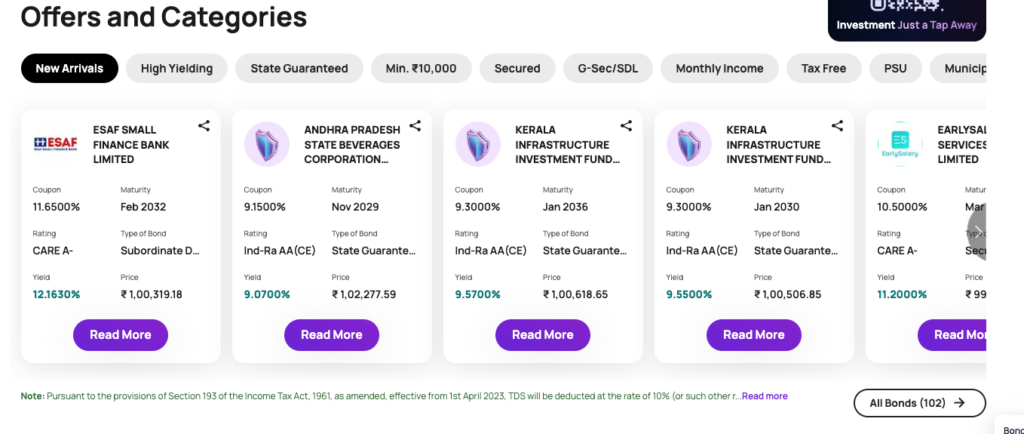

2. Fixed Income: Bonds Are Back in the Spotlight

For years, bonds were ignored. In 2026, they matter again.

What Works Best

- Government bonds for stability

- High-quality corporate bonds for income

- Short- to medium-duration bonds to manage rate risk

Why Bonds Matter in 2026

- Provide steady income

- Reduce portfolio volatility

- Act as a buffer during equity corrections

Bonds are no longer “boring” — they are useful again.

3. Gold and Precious Metals: Portfolio Insurance

Gold and silver are not about fast growth.

They are about protection.

Why They Belong in a Portfolio

- Hedge against currency weakness

- Protection during geopolitical stress

- Store of value in uncertain monetary conditions

A modest allocation can stabilize returns when markets become unpredictable.

4. Real Estate: Selective and Strategic

Real estate in 2026 is not about buying everything — it’s about choosing carefully.

Attractive Areas

- Rental housing in high-demand cities

- Logistics and warehousing

- Data centers and digital infrastructure

- REITs for liquidity and diversification

What to Avoid

- Overleveraged properties

- Markets with weak population growth

Real estate still works, but only with discipline and patience.

5. Alternative Investments: Small but Meaningful Exposure

Alternative assets can enhance returns when used wisely.

Examples

- Private equity funds

- Infrastructure projects

- Commodities beyond precious metals

These are best kept as satellite investments, not core holdings.

6. Cash and Liquidity: An Underrated Asset

Holding cash is no longer a mistake.

Why Cash Matters

- Earns reasonable yields

- Provides flexibility during market dips

- Reduces forced selling during volatility

Cash is not idle — it is strategic optionality.

A Sample Diversified Allocation for 2026

This is only an illustration, not financial advice:

- Equities: 40–50%

- Bonds: 20–30%

- Real Estate: 10–15%

- Gold & Commodities: 5–10%

- Cash & Alternatives: 5–10%

The exact mix depends on your risk tolerance and goals.

Key Investment Principles for 2026

- Diversify across asset classes

- Avoid emotional decision-making

- Focus on long-term trends

- Rebalance regularly

- Don’t chase market headlines

Consistency matters more than prediction.

Final Thoughts

The best investment opportunities in 2026 are not about finding the next big thing.

They are about building a resilient, diversified portfolio that can grow through uncertainty- Best investments 2026.

Markets will move. Headlines will change.

A well-structured strategy will outlast both.

Also read our article on –Scapia vs Niyo Credit Card (2025): Features, Rewards, Fees & Best Choice

#Investing2026 #WealthBuilding #Diversification #LongTermInvesting #FinancialPlanning