The Crypto Market’s Sudden Downturn — What Happened?

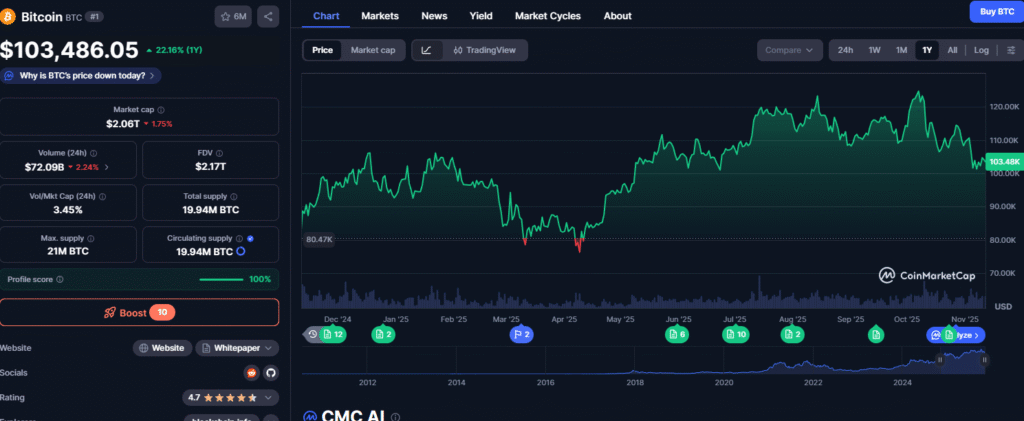

If you’ve checked your crypto portfolio recently, you’ve likely noticed a sea of red. Bitcoin’s price has tumbled sharply, dragging altcoins into a deep correction. But why has this happened — and what does it mean for the future of crypto investors? – Bitcoin crash

Let’s break it down.

1. Macroeconomic Pressure Is Squeezing Risk Assets

Bitcoin and the broader crypto market are highly sensitive to global macro trends. With inflation remaining sticky and central banks signaling higher-for-longer interest rates, investors are shifting away from riskier assets. This “risk-off” environment hits cryptocurrencies first, leading to heavy selling pressure.

Additionally, the strength of the U.S. dollar — often seen as a safe haven — has increased. Historically, Bitcoin tends to struggle when the dollar index (DXY) rises, creating a perfect storm for price weakness.

2. Profit-Taking After a Massive Run-Up

Let’s not forget: Bitcoin surged dramatically over the past year, crossing several resistance levels. When assets rise too quickly, a correction is almost inevitable. Many traders and institutions have taken profits, especially near psychological levels like $70,000, leading to cascading sell orders.

Altcoins, which usually follow Bitcoin’s lead, are more volatile and have suffered deeper declines — often 30–50% from their recent highs.

3. ETF Hype Cooling Down

After Bitcoin ETF approvals, enthusiasm soared. But as the excitement faded and “buy the rumor, sell the news” sentiment took over, inflows slowed. Without strong new demand, prices began retracing.

4. On-Chain Data Shows Weak Hands Are Selling

On-chain analytics platforms are showing that short-term holders are capitulating, while long-term holders (whales and institutions) are largely unmoved. This suggests we’re in a healthy correction phase — not the start of a long-term bear market.

What the Future Holds for Bitcoin and Altcoins

Short-Term: Volatility Ahead

Expect continued volatility as markets digest macro data and interest rate policy updates. Bitcoin could consolidate in the $50K–$55K range before making its next major move.

Mid-Term: Institutional Accumulation

Institutional adoption isn’t slowing down. Major financial players continue to expand crypto exposure, build custody solutions, and integrate blockchain-based infrastructure. This accumulation phase could set the stage for the next leg up once market sentiment improves.

Long-Term: The Bull Case Remains Strong

The fundamentals of Bitcoin — limited supply, increasing scarcity through halving events, and growing integration with traditional finance — remain unchanged. Historically, each major correction has been followed by a stronger rally.

What You Should Do Now

1. Don’t Panic Sell

Corrections are normal. Reacting emotionally can lead to missed opportunities. Historically, Bitcoin has always recovered and reached new all-time highs after every major drawdown.

2. Dollar-Cost Average (DCA)

For long-term believers, DCA remains one of the smartest strategies. It reduces risk by spreading purchases over time and taking advantage of lower prices.

3. Diversify Smartly

Not all altcoins will survive the next cycle. Focus on projects with real utility, strong development teams, and solid communities.

4. Stay Informed, Not Emotional

Follow credible sources, track on-chain data, and avoid hype-driven decisions. Understanding market cycles will help you stay ahead.

Final Thoughts

This correction isn’t the end of crypto — it’s a natural part of the cycle. The same forces that brought Bitcoin to $70K are still at play, just taking a breather. Smart investors know that volatility is an opportunity in disguise.

As the saying goes: “Be fearful when others are greedy, and greedy when others are fearful.” The current correction might just be the setup for the next major breakout – Bitcoin crash.

You now know more about Bitcoin than 99% of people around you. Welcome to the revolution.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast. Also, read our article on – How the Elon Musk–Donald Trump Feud and Epstein Files Are Quietly Rocking the Crypto Market

#BitcoinCrash #CryptoCorrection #BTC #Altcoins #CryptoMarket #Investing #Blockchain #CryptoNews Bitcoin crash