Bitcoin Reclaims $97,000: What’s Fueling the Crypto Surge and What’s Next?

Crypto Investing time is Back:

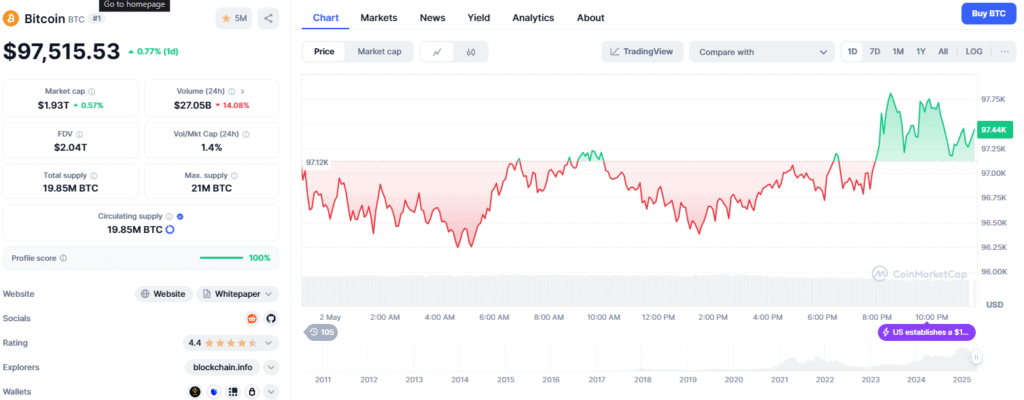

Bitcoin is back in the spotlight after breaking through the $97,000 mark—its highest level in recent months in the crypto investing. This significant recovery has not only thrilled investors but has also reignited discussions around the next big phase in the cryptocurrency cycle.

But what’s driving this price movement, and is it here to stay?

Let’s break down the reasons behind the current surge and what might be next for the world’s leading cryptocurrency and what lies ahead in the crypto investing for you as an investor.

1. Institutional Adoption Is Accelerating

Large financial players are no longer sitting on the sidelines. Investment giants, pension funds, and publicly traded companies are increasing their crypto exposure, with Bitcoin being the primary asset of interest. The recent approval of multiple Bitcoin ETFs (Exchange-Traded Funds) has made it easier for institutions to invest, leading to massive capital inflows.

2. Limited Supply Meets Growing Demand

Bitcoin’s fixed supply of 21 million coins creates a natural scarcity. As demand rises, especially from long-term holders and institutional investors, supply becomes tighter. This classic supply-demand dynamic is pushing prices upward.

Additionally, the recent Bitcoin halving event has reduced mining rewards, slowing the rate at which new Bitcoins enter circulation—further fueling the price rally.

3. Global Economic Uncertainty

With inflation fears, interest rate shifts, and banking instability affecting traditional markets, investors are turning to Bitcoin as a hedge. The narrative of Bitcoin as “digital gold” is strengthening, especially in regions facing currency devaluation or geopolitical tensions.

4. Bullish Market Sentiment and FOMO

Market psychology plays a huge role in crypto price movements. As Bitcoin surged past key resistance levels, Fear of Missing Out (FOMO) has kicked in. Retail investors, influencers, and media outlets are amplifying the buzz, attracting even more buyers and creating a feedback loop of bullish sentiment.

5. Improved Regulatory Clarity

Several countries, including the U.S., have recently outlined clearer regulations for digital assets. This clarity reduces uncertainty for institutional investors and opens doors for more mainstream adoption. A regulated environment signals legitimacy and long-term viability, contributing to positive market momentum.

What’s Ahead for Bitcoin and the Crypto Market?

✅ Short-Term Outlook:

Expect some volatility. As always with crypto, price corrections may follow such sharp gains. However, technical indicators remain bullish in the short term, suggesting momentum could push Bitcoin toward new all-time highs.

🔭 Long-Term Potential for crypto investing:

If macroeconomic conditions continue to support decentralized finance and digital assets, Bitcoin’s role as a global digital store of value will only strengthen. Some analysts predict that breaking the $100,000 barrier could trigger a full-scale crypto bull market.

Should You Invest Now?

If you’re considering entering the crypto space, it’s crucial to:

- Understand market volatility

- Diversify your investments

- Research before buying in

- Invest only what you can afford to lose

While Bitcoin’s fundamentals are stronger than ever, timing the market remains challenging. A strategic, long-term mindset is often the best approach.

Final Thoughts on Bitcoin for Crypto investing.

Bitcoin reclaiming $97,000 is more than just a price milestone—it’s a signal that crypto is entering a new growth phase. With institutional backing, regulatory support, and a maturing market, the foundation for sustained momentum is being laid.

But remember, in crypto, the only constant is change. Stay informed, stay cautious, and read and study before crypto investing. It is always said to not keep all your coins in the same basket, so diversify.

Read more updates and articles on our Crypto category page and also for Bitcoin price Forecast

#Bitcoin2025 #CryptoBullRun #AltcoinRally #CryptoNews #BlockchainTrends #CryptoInvesting #BitcoinPrice #BullMarketCrypto