Bitcoin Recovery: Risks and Opportunities in 2025

Introduction

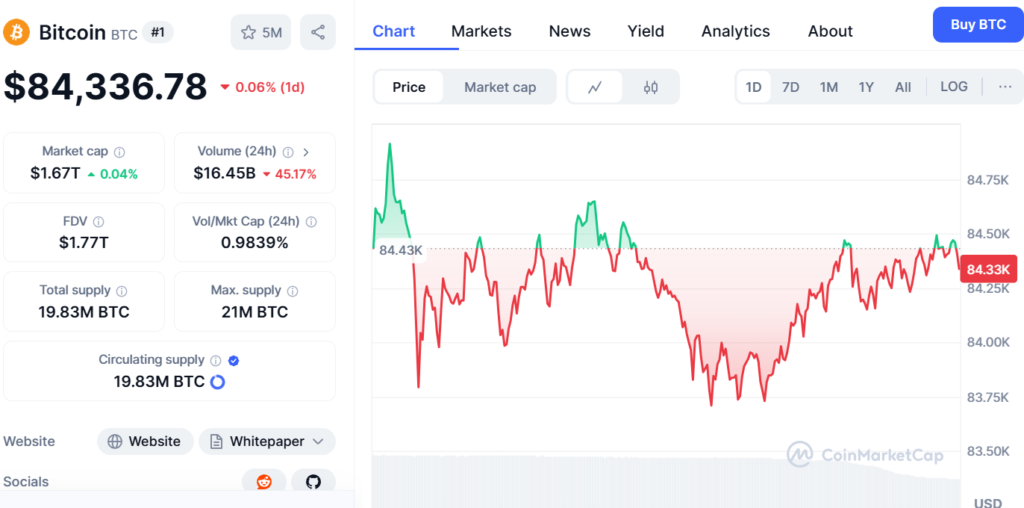

Bitcoin’s price has experienced a modest recovery from its recent monthly lows, yet it continues to face key resistance at $85,000. While the cryptocurrency market remains volatile, Bitcoin is navigating a complex landscape filled with both risks and opportunities.

As of the latest data, Bitcoin has risen 10% from its lowest point this month, reaching $84,525 on Saturday. However, it remains in a local bear market, having fallen over 22% from its highest peak this year. At the time of writing, Bitcoin is trading at $84,335.

Beyond crypto, traditional markets like stocks and commodities have also seen gains. The Dow Jones index surged by over 650 points, while the S&P 500 and Nasdaq 100 climbed 117 and 450 points, respectively. Meanwhile, gold reached a record high of $3,010.

Potential Risks for Bitcoin Recovery

Bitcoin’s road to recovery is not without obstacles. Two major risks could impact its short-term trajectory:

1. Persistent Investor Fear

Market sentiment remains a significant challenge for Bitcoin’s resurgence. Although the Fear and Greed Index has moved out of the extreme fear zone of 18, it is still lingering in the fear zone at 22. Historically, Bitcoin performs best when this index enters the greedy zone.

This lingering fear has resulted in continued outflows from spot Bitcoin ETFs, which shed $143 million in assets, contributing to a total of $870 million in weekly outflows. Notably, this marks the fifth consecutive week of capital flight from Bitcoin ETFs, suggesting that investor confidence remains fragile.

2. Technical Indicators Signal Bearish Trends

From a technical perspective, Bitcoin has formed a death cross, a bearish signal triggered when the 50-day and 200-day Weighted Moving Averages (WMAs) cross. Historically, this pattern has led to extended periods of downside movement.

Given these indicators, Bitcoin could potentially retrace to $73,900, a crucial resistance level recorded in March 2024. If bearish momentum persists, the cryptocurrency may struggle to gain upward traction.

Opportunities for Bitcoin’s Recovery

Despite these challenges, two major factors could work in Bitcoin’s favor and pave the way for a bullish rebound.

1. Federal Reserve Policy and Interest Rate Decisions

Bitcoin’s first major opportunity lies in the Federal Reserve’s monetary policy. The central bank is set to hold its second meeting of the year on March 18-19, which could shape investor sentiment.

If recession concerns push the Fed toward a dovish stance, it may signal future interest rate cuts. A shift in this direction would likely benefit Bitcoin, altcoins, and other risk assets, as lower interest rates historically drive liquidity into speculative investments.

2. Renewed Risk Appetite and Market Recovery

Another potential catalyst for Bitcoin’s resurgence is the return of a risk-on sentiment in global markets. Following a period of extreme volatility, investors may start to buy the dip, a phenomenon previously observed during the COVID-19 market crash in 2020.

Back then, panic selling wiped out trillions in stock and crypto valuations before a strong recovery was fueled by aggressive Federal Reserve stimulus measures. A similar shift in sentiment could drive Bitcoin higher if investors regain confidence in riskier assets.

Conclusion

Bitcoin’s recovery remains at a crossroads, balancing between key risks and promising opportunities.

- Risks: Persistent investor fear and bearish technical indicators could drive further downside.

- Opportunities: A dovish Fed and renewed risk appetite could trigger a strong rebound.

As the cryptocurrency landscape continues to evolve, investors should monitor macroeconomic trends, technical indicators, and market sentiment to navigate the road ahead effectively. Though, people are saying that this year 2025 is the bull run, so prices can shoot up.

CoinDCX: For traders and investors in India, CoinDCX is the best platform which has quick deposits and withdrawls, lowest fee and CoinDCX is the platform I trust to learn, invest & trade in Crypto. Buy your first crypto and win up to ₹5,00,000 in crypto rewards!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#Bitcoin #Crypto #BTC #CryptoMarket #Investment #Trading #Blockchain #BitcoinPrice #CryptoNews