Crypto Chaos: Bitcoin Crashes Below $87K – What’s Next?

Bitcoin Dives Below $87,000 Amid Market Turmoil: Crypto Market Crash 🚨

In a dramatic market downturn, Bitcoin has plummeted below the $87,000 threshold, triggering widespread panic and uncertainty across the cryptocurrency landscape. The sharp decline has had a ripple effect on the broader crypto market, with major altcoins such as Ethereum, Solana, and Ripple’s XRP also facing substantial losses.

Bitcoin’s Price Tumbles to Multi-Month Low

As of the latest market data, Bitcoin’s price has slumped to $86,887, its lowest level since mid-November. This steep drop is attributed to a confluence of factors, including a major security breach at a leading exchange, massive outflows from U.S. Bitcoin exchange-traded funds (ETFs), and a shifting macroeconomic landscape.

The Crypto Fear & Greed Index has nosedived to 25, signaling “extreme fear” among investors, a sentiment shift not seen since September. Meanwhile, liquidations have surged to $1.48 billion in the past 24 hours, with Bitcoin and Ethereum leading the sell-off.

The broader crypto market has experienced a 10% decline in total valuation within the past day, with some coins suffering even heavier losses. XRP, for example, has dropped by 15.6% in the past 24 hours and nearly 20% in the past week. Analysts suggest that this market-wide downturn is exacerbated by external economic pressures, including the strengthening of global currencies and investor risk aversion.

Key Market Indicators and Bitcoin’s Technical Breakdown

Bitcoin’s plunge below $88,000 on Tuesday morning marks its lowest level in three months. The drop comes as global markets reacted sharply to former U.S. President Donald Trump’s confirmation that tariffs on Canada and Mexico will proceed as scheduled next week.

Market data from CoinMarketCap shows Bitcoin dipping as low as $87,190, reflecting an 8% decline over the past 24 hours. This represents Bitcoin’s steepest daily decline since January 25, when it lost 5.2% in a single day. The flagship cryptocurrency had been trading within a consolidation range of $91,000–$102,000 for nearly three months before breaking through critical support levels.

Technical analysts warn that Bitcoin is now testing the lower boundary of its consolidation range, with the next major support level near $86,000, where the 200-day exponential moving average (EMA) is positioned. A further drop below this level could intensify selling pressure.

Massive Liquidations and Institutional Sell-Offs

According to the QCP Group, Bitcoin “finally broke out of its range, dipping below $90K for the first time in a month, triggering over $200 million in liquidations within hours.”

Data from Coinglass paints an even grimmer picture, showing total liquidations reaching $1.50 billion over the past 24 hours. Long positions bore the brunt of the losses, with $1.37 billion in liquidations, while short positions accounted for $129.48 million.

What’s Fueling the Sell-Off?

Several macroeconomic and industry-specific factors have contributed to the latest crypto crash:

- U.S. Trade Tariffs and Economic Concerns – In a White House press conference, Trump reaffirmed that his administration’s 25% tariffs on imports from Canada and Mexico will go into effect as planned. Additionally, a 10% tariff on Canadian energy products and Chinese goods is also set to be implemented.Trump argues that these tariffs will help reduce the federal deficit and create jobs, but economists warn that they could accelerate inflation.

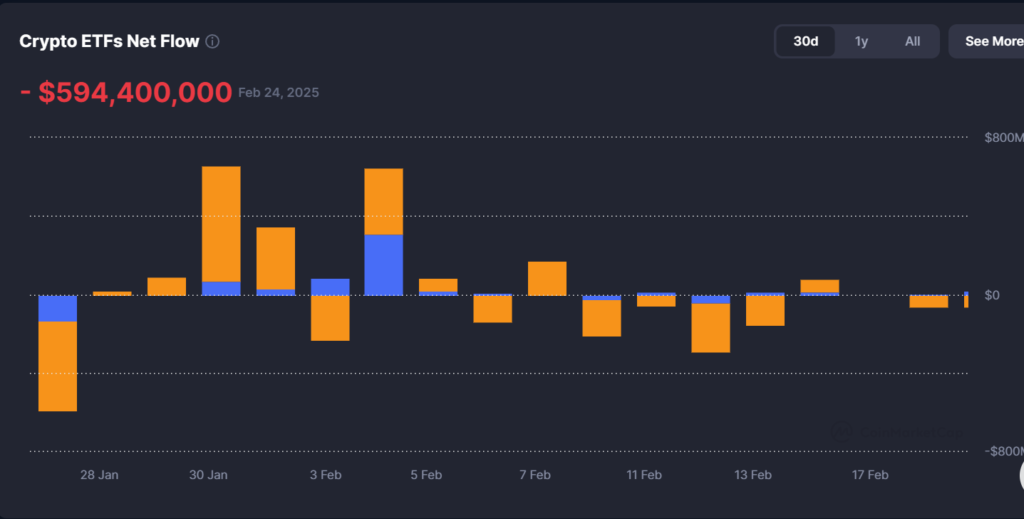

- Institutional Outflows from Bitcoin ETFs – The recent slowdown in institutional demand for Bitcoin ETFs has contributed to selling pressure. Analysts note that after a strong start in early 2024, spot Bitcoin ETFs have seen declining inflows, suggesting that institutional investors are taking a cautious stance amid economic uncertainty.

- Tech Sector Volatility – The U.S. government’s recent crackdown on technology exports, particularly affecting semiconductor giants like Nvidia, has led to significant losses in the tech sector. Given Bitcoin’s increasing correlation with traditional financial markets, this volatility has spilled over into crypto.

- Security Concerns and Exchange Breaches – A major security breach at a prominent crypto exchange has further rattled investor confidence, prompting many to move their holdings off exchanges and into cold storage, leading to lower trading volumes and increased volatility.

Solana Takes a Beating: Token Unlock and Market Exodus

Solana (SOL) has been hit particularly hard, dropping below $145 for the first time in 2024 and extending losses to $133. Over the past 30 days, Solana has plummeted by 46.6%, with multiple factors contributing to its decline:

- FTX Bankruptcy Token Unlock – On March 1, approximately 11.2 million SOL tokens linked to the FTX bankruptcy proceedings are set to be unlocked, leading to fears of oversupply and preemptive selling.

- Declining On-Chain Activity – Active daily addresses on the Solana network have fallen from 5.7 million to 3.5 million in the last month, impacting decentralized exchange (DEX) volumes and network fees.

- Memecoin Collapse and Security Issues – The LIBRA token, once valued at over $4 billion, lost more than 90% of its value, draining liquidity from Solana’s memecoin market.

Looking Ahead: What’s Next for Bitcoin and the Crypto Market?

With Bitcoin testing key support levels and macroeconomic uncertainty on the rise, investors remain on edge. Analysts suggest that a decisive move below $86,000 could lead to further losses, while a recovery above $90,000 might restore confidence.

The coming weeks will be crucial in determining the market’s trajectory. Key factors to watch include upcoming Federal Reserve policy decisions, institutional investor sentiment, and global economic developments. Until then, the crypto market remains highly volatile, with both opportunities and risks at play for traders and long-term investors alike.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

Bitcoin #CryptoCrash #BTC #Ethereum #Solana #XRP #CryptoNews #Blockchain #Investing #CryptoMarket