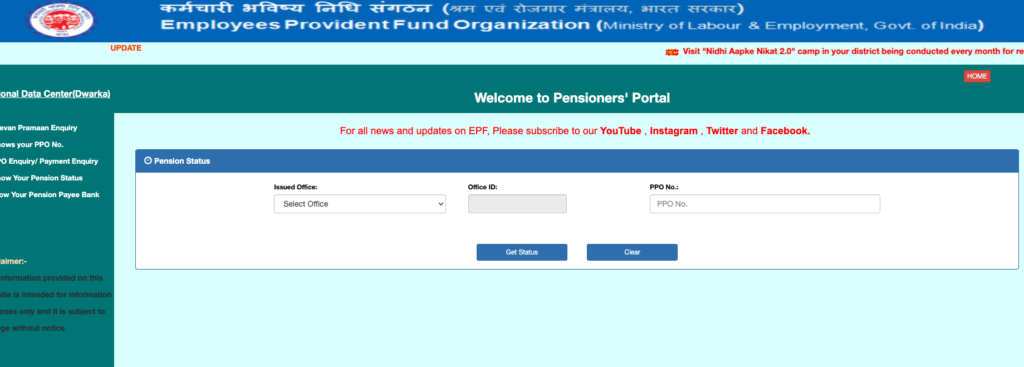

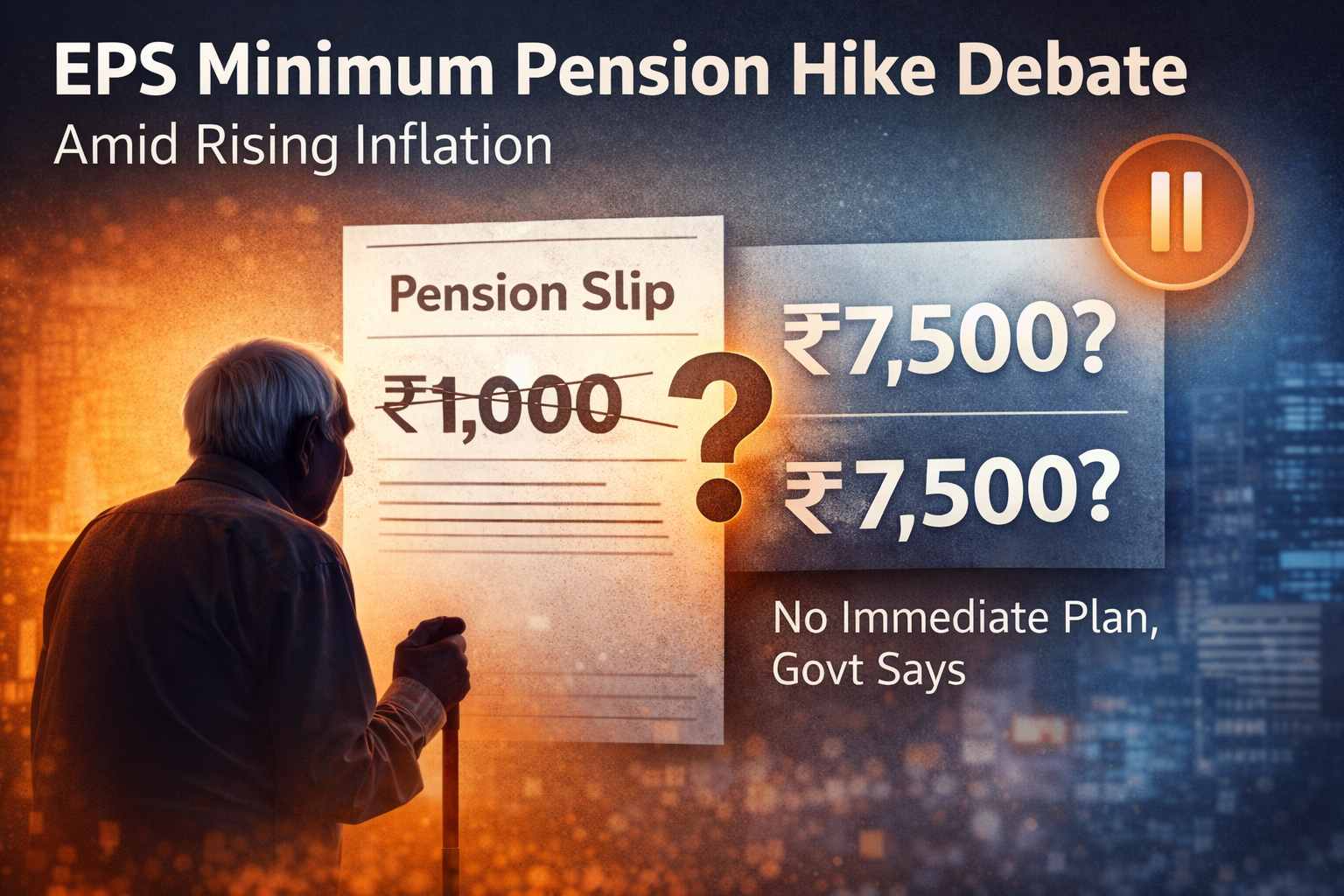

Explained EPFO Update: No Immediate Plan to Raise Minimum EPS Pension to ₹7,500, Govt Tells Parliament

The Union government has once again clarified that there is no immediate proposal to increase the minimum pension under the Employees’ Pension Scheme (EPS), 1995 from ₹1,000 to ₹7,500, despite persistent demands from pensioners and concerns over rising inflation – EPS minimum pension hike.

Responding to a query in the Rajya Sabha, the Labour Ministry said that any revision in the minimum pension must take into account the long-term financial sustainability of the pension fund, which is reviewed through annual actuarial valuations.

Govt Reiterates Its Stand on EPS Pension Revision

Clarifying the government’s position, the Labour Ministry said there is currently no separate proposal or fixed timeline to revise the minimum EPS pension.

The response comes amid growing calls from pensioners’ groups and labour unions to raise the payout, which has remained unchanged at ₹1,000 for over a decade.

The ministry stressed that the Employees’ Pension Scheme operates as a defined contribution–defined benefit social security system, and changes to benefits must be aligned with the fund’s financial health.

MP Raises Pensioners’ Hardship Amid Inflation

The issue was raised by Rajya Sabha MP Dr Medha Vishram Kulkarni, who highlighted the financial difficulties faced by EPS-95 pensioners, particularly in Maharashtra, where thousands of retirees have been demanding an increase in the minimum pension to ₹7,500.

The MP asked whether the government was aware of these demands, whether representations had been received from pensioners’ associations and employee unions during 2025, and if any actuarial studies had been conducted specifically to assess the feasibility of a higher pension.

She also sought clarity on whether the Centre had any timeline in mind for revising the pension amount.

Labour Minister Explains How EPS Works

Replying on behalf of the government, Minister of State for Labour and Employment Shobha Karandlaje explained that the Employees’ Pension Fund is financed through:

- An 8.33% contribution by employers from employees’ wages

- A 1.16% contribution by the Central Government on wages up to ₹15,000 per month

All pension payments under EPS-95 are made from this pooled fund.

The minister also pointed out that the Centre currently supports a minimum pension of ₹1,000 per month through budgetary allocations.

In addition to its regular contribution routed via the Employees’ Provident Fund Organisation.

Annual Fund Valuation and Sustainability Concerns

Addressing concerns over the viability of the pension fund, the minister said that EPS funds are valued annually under the provisions of EPS, 1995. These valuations assess whether future contributions will be sufficient to meet long-term pension liabilities.

She emphasised that while the government remains committed to strengthening social security through EPF, EPS and EDLI schemes, decisions on benefit enhancements must balance pensioners’ needs with the fund’s sustainability.

Demands Acknowledged, But No State-Specific Fund

The Labour Ministry acknowledged receiving multiple representations from trade unions, pensioners’ bodies and public representatives seeking a hike in the minimum EPS pension.

However, it clarified that EPS-95 does not operate state-wise funds. The pension scheme is centrally pooled, and demands from any state — including Maharashtra — are examined at the national level.

A Long-Standing Demand With No Immediate Resolution

The demand to increase the minimum EPS pension has been raised repeatedly over the years, with unions arguing that the current ₹1,000 payout is inadequate given rising living and healthcare costs. While the government has consistently said the issue is under consideration, it has also maintained that any increase must be supported by actuarial assessments- EPS minimum pension hike.

For now, the latest parliamentary response makes it clear that there is no immediate plan to raise the minimum EPS pension to ₹7,500, and that any future decision will depend on financial evaluations rather than fixed timelines.

Also read our article on –Scapia vs Niyo Credit Card (2025): Features, Rewards, Fees & Best Choice

#EPFO #EPSPension #PensionUpdate #RetirementSecurity #InflationImpact #IndiaFinance #LabourMinistry