Income Tax Filing 2025: ITR 1, 2, 3 & 4 Explained – Forms, Deadlines & AI Tools for Hassle-Free Filing

Income Tax Filing 2025 is ready now for you 📌

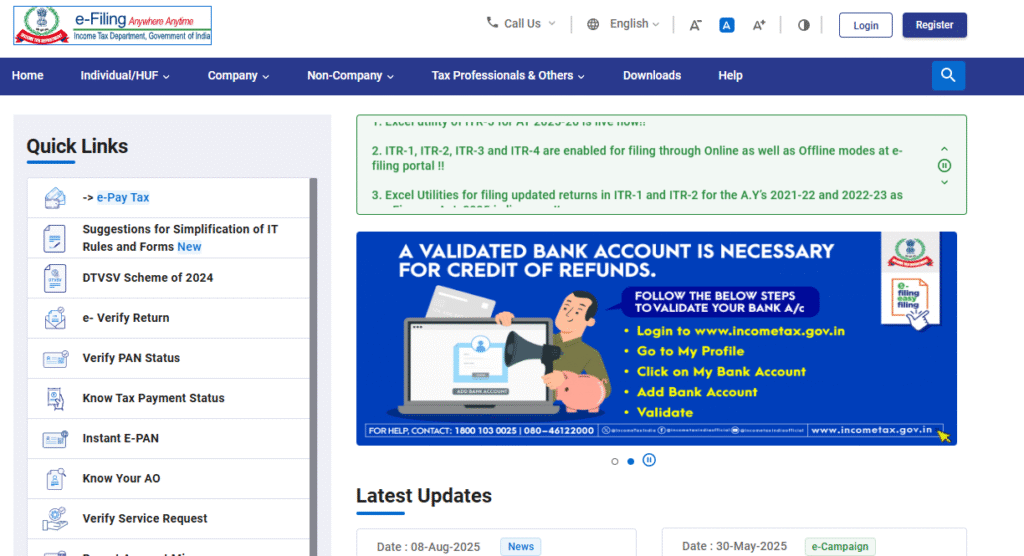

Income Tax Filing 2025 -The income tax filing window for Assessment Year (AY) 2025–26 is officially open, and the Income Tax Department has activated all four major ITR forms – ITR 1, ITR 2, ITR 3, and ITR 4. Whether you’re a salaried employee, a business owner, or a freelancer, selecting the correct form is crucial to avoid errors, penalties, and processing delays.

In this guide, we’ll break down:

- What each ITR form is for

- The deadlines for filing

- AI-powered platforms that can make self-filing quick and stress-free

1. Understanding the ITR Forms

🔹 ITR 1 (Sahaj)

- For: Salaried individuals, pensioners, and taxpayers with income from one house property.

- Annual Income Limit: Up to ₹50 lakh.

- Not for: Capital gains, foreign income, or agricultural income above ₹5,000.

🔹 ITR 2

- For: Individuals and HUFs without business or professional income.

- Covers: Capital gains, multiple house properties, and foreign assets/income.

🔹 ITR 3

- For: Individuals/HUFs earning from business or profession.

- Includes: Freelancers, consultants, and those with income from proprietary businesses.

🔹 ITR 4 (Sugam)

- For: Small businesses and professionals under the Presumptive Taxation Scheme (Sections 44AD, 44ADA, and 44AE).

- Annual Income Limit: Up to ₹50 lakh.

2. Filing Deadlines for AY 2025–26

- Individual taxpayers (non-audit cases): July 31, 2025

- Taxpayers requiring audit: October 31, 2025

- Revised/Belated returns: December 31, 2025

Pro Tip: Filing early can help you avoid last-minute rush, server slowdowns, and penalty interest.

3. AI-Powered Tax Filing Platforms

Thanks to advancements in Generative AI and automation, tax filing has become faster and more accurate. These platforms analyze your income details, auto-fill relevant sections, detect missing information, and suggest tax-saving options.

Popular AI-based self-filing tools in India:

- ClearTax – AI-assisted data extraction from Form 16, bank statements, and investment proofs.

- Quicko – Smart tax planning with real-time error detection.

- TaxBuddy – Conversational AI support for filing guidance.

4. Tech Analysis – Why AI is a Game-Changer for Tax Filing

Before AI: Filing taxes required manual entry, understanding complex laws, and risked costly mistakes.

With AI:

- Data Automation: Direct import of Form 16, AIS, and TIS data.

- Error Detection: Flags mismatches instantly.

- Smart Suggestions: Identifies unused deductions under sections like 80C, 80D, etc.

- Faster Refunds: Accurate filing reduces processing delays.

Given India’s increasing shift toward digital-first compliance, AI filing tools are not just a convenience—they’re becoming the new standard for efficiency.

5. Final Thoughts

Income Tax Filing 2025 – Filing your ITR on time with the correct form ensures compliance, avoids penalties, and speeds up refunds. With AI-powered tax platforms, self-filing is no longer a headache—it’s a streamlined, error-free process that even beginners can handle confidently.

If you haven’t filed yet, identify your form, prepare your documents, choose an AI tool, and get it done before the deadline.

Also, read our other article Top 5 US Stocks to Buy in August 2025 for Short & Long-Term Growth – Expert Analysis

Check out more article on Finance on our Finance Category section.

#IncomeTax2025 #ITRFiling #SelfFiling #AITaxFiling #TaxSeasonIndia #IncomeTaxReturn #ITRForms #TaxTips2025