Indian Stock Market Outlook 2025: Key Trends, Nifty 50 Predictions & Safe Investment Strategies

Indian Stock Market Outlook

The Indian stock market continues to be a powerhouse of economic growth, driven by strong corporate earnings, macroeconomic stability, and robust retail participation. As we progress through 2025, investors are keeping a close watch on multiple factors that could influence market trends.

Key Factors Affecting the Indian Stock Market

- Economic Growth & Policy Reforms: The Indian economy is projected to grow at a steady pace, supported by government policies focusing on infrastructure, manufacturing, and digital transformation.

- Global Market Trends: Interest rate decisions by the U.S. Federal Reserve, geopolitical tensions, and global commodity prices impact foreign inflows into Indian equities.

- Corporate Earnings: Strong earnings reports from leading companies continue to support market valuations and investor confidence.

- FII & DII Activity: Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII) play a crucial role in determining market sentiment and liquidity levels.

- Inflation & Interest Rates: The Reserve Bank of India’s (RBI) stance on interest rates and inflation control will be a critical factor in shaping market movements.

- Sectoral Growth: Banking, IT, infrastructure, and energy are key sectors expected to drive stock market performance in the coming months.

Nifty 50 Outlook for 2025

Market experts predict that Nifty 50 could range between 21,500 to 27,000 by the end of 2025, given the current economic trajectory and investor sentiment. Short-term volatility may persist, but long-term growth remains strong.

The resistance of major level is 22,900. If nifty breaks that then it can go way higher and give good returns.

Safe Investment Strategy: Blue-Chip Stocks & ETFs

For investors looking for stability and long-term wealth creation, Blue-chip stocks and Exchange-Traded Funds (ETFs) are excellent choices. These stocks belong to well-established companies with strong fundamentals, consistent returns, and lower risk compared to mid or small-cap stocks.

Top Blue-Chip Stocks to Consider:

- Tata Group Stocks: Companies like Tata Consultancy Services (TCS) and Tata Steel continue to show strong fundamentals and growth potential.

- Reliance Industries: A diversified giant with interests in telecom, retail, energy, and green initiatives.

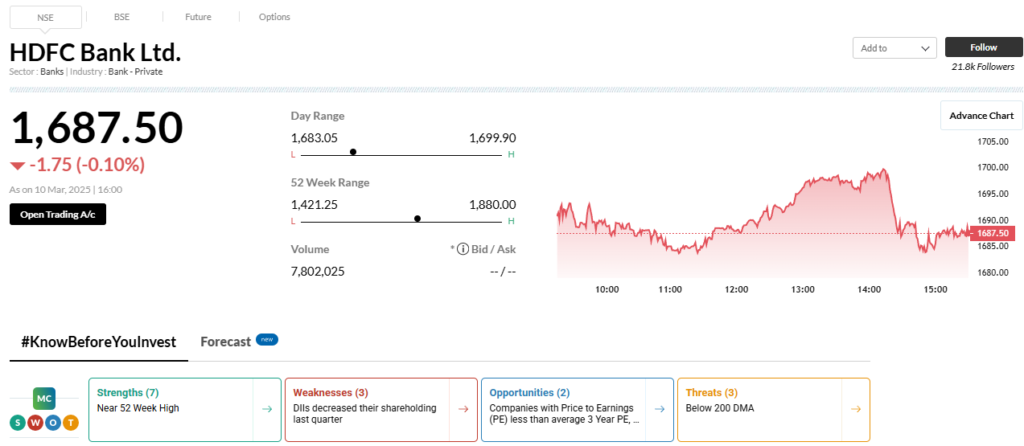

- HDFC Bank: A market leader in the banking sector with solid financials.

- ICICI Bank: Another banking powerhouse with significant market share and digital transformation strategies.

- Adani Group Stocks: Infrastructure, power, and renewable energy investments make Adani stocks an attractive choice.

Conclusion

The Indian stock market outlook for 2025 remains positive, despite short-term fluctuations. By investing in blue-chip stocks and ETFs, investors can build a robust and diversified portfolio that balances growth and risk management. As always, staying informed and making strategic investments is key to navigating the market successfully.

Indian Stock market still holds a positive outlook. It has stood the winds of change and proved itself time and time again. There is still a possibility of growth of 10-25% more by this year end.

Read our Previous Article: Nifty 50 Outlook 2025: Can India’s Stock Market Rally 20%?

Got questions? Drop them below—I’m all ears!

Check out more article on Finance on our Finance Category section.

#Nifty50 #StockMarketIndia #Investing #StockMarketOutlook #Sensex #IndianEconomy #MarketPredictions #NSE #BSE #Finance