ITR Filing FY 2024-25 Extended: All ITR Forms Released – Deadlines, Process & Key Updates

ITR Filing FY 2024-25 Extended: A Big Relief for Taxpayers

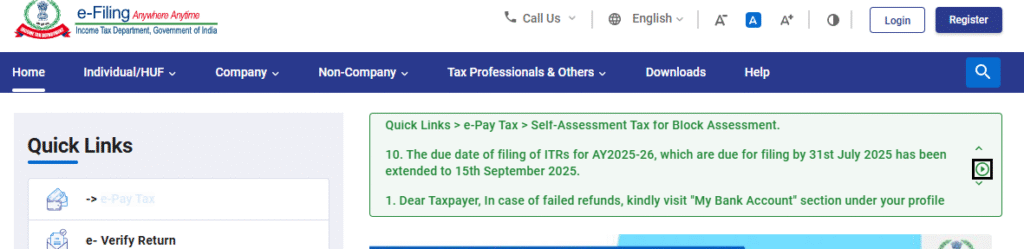

Taxpayers in India can breathe a sigh of relief as the Income Tax Department has officially extended the deadline for filing Income Tax Returns (ITR) for FY 2024-25. Alongside this announcement, the department has also made all ITR forms (1 to 7) available online on the income tax e-filing portal, ensuring that individuals, professionals, and businesses can now file returns without delay.

The move comes in response to technical feedback, compliance requirements, and requests from taxpayers who needed more time to complete their filings.

📅 New ITR Filing Deadline

While the exact extension date may vary depending on the category of taxpayer, the central government has confirmed that taxpayers will have additional weeks beyond the original July 31 deadline to submit their returns without penalties.

- For Individuals (ITR-1 & ITR-2): Extended beyond July 31, 2025.

- For Businesses & Professionals (ITR-3 & ITR-4): Extended beyond September 30, 2025.

- For Companies (ITR-6): Extended beyond October 31, 2025.

(Exact dates will be specified by the CBDT circular and updated on the e-filing portal.)

📂 ITR Forms Released for FY 2024-25

The following forms are now live on the portal:

- ITR-1 (Sahaj): For salaried individuals with income up to ₹50 lakh.

- ITR-2: For individuals and HUFs with income from salary, house property, and capital gains.

- ITR-3: For individuals and HUFs carrying on business or profession.

- ITR-4 (Sugam): For presumptive income taxpayers (small businesses and professionals).

- ITR-5: For LLPs, partnership firms, and other entities.

- ITR-6: For companies other than those claiming exemption under section 11.

- ITR-7: For trusts, charitable institutions, and political parties filing returns.

⚙️ How to File ITR Online for FY 2024-25

- Visit the Income Tax e-Filing Portal (incometax.gov.in).

- Log in using your PAN/Aadhaar and password.

- Select the relevant ITR form.

- Enter income details, deductions, and TDS data (auto-populated in most cases).

- Verify using Aadhaar OTP, Net Banking, or DSC.

- Submit the return and download the acknowledgement (ITR-V).

🔍 Impact of Extension on Taxpayers

- More Time to File Accurately: Salaried individuals, freelancers, and business owners get additional time to gather documents and file error-free returns.

- Avoiding Penalties: The extension prevents taxpayers from paying late filing fees under Section 234F.

- Ease for Businesses: Audit and compliance-heavy businesses get breathing space to finalize accounts before filing.

- Better Use of Pre-Filled Data: Taxpayers can cross-check pre-filled TDS, salary, and bank interest details on the portal for accuracy.

📊 Why the Extension Was Needed

- Technical Testing: The new e-filing 2.0 portal is undergoing regular system upgrades to handle massive traffic.

- Taxpayer Feedback: Multiple requests were raised for more time due to compliance overlaps.

- Audit Season Pressure: Businesses and professionals required extra weeks to complete audits and reconciliations.

📌 Conclusion: File Early, Stay Compliant

The extension of the ITR filing deadline for FY 2024-25 is a relief for millions of taxpayers. With all ITR forms now available online, individuals and businesses should use this time to file early, avoid last-minute rush, and ensure error-free compliance.

Whether you’re a salaried employee filing ITR-1, a professional filing ITR-3, or a business filing ITR-6, the updated system promises a smoother experience with faster validations.

👉 Start preparing your documents now and file ahead of the extended deadline to stay stress-free.

#ITRFiling #IncomeTaxIndia #ITR2025 #TaxReturn #ITRForms #FinanceIndia #TaxpayerUpdate #IncomeTaxReturn #TaxDeadline