Trump’s Crypto Reserve Sparks surge in XRP, SOL, ADA, BTC—What’s Next?

The crypto market has been set ablaze, and the spark? None other than U.S. President Donald Trump. On March 2, 2025, Trump announced his administration’s bold move to establish a U.S. Crypto Strategic Reserve featuring XRP, Solana (SOL), Cardano (ADA), and Bitcoin (BTC), proclaiming it a cornerstone to “Make America Great Again.” The news, dropped like a thunderbolt on Truth Social, has ignited a frenzy, with top cryptocurrencies surging 20-50% in just the last hour. After weeks of turbulence, the market is rebounding with a vengeance—but how far can this rally go? Let’s dive into the chaos, the charts, and the potential.

We had given indication 2 days back in our Bitcoin post that it is a buying opportunity 💸🤑💰

Crypto to the Moon🚀

The Announcement That Shook the Market

Picture this: a sleepy Sunday morning, crypto traders sipping coffee, when Trump’s post hits at around 8:00 AM PST. “A U.S. Crypto Reserve will elevate this critical industry… my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, ADA, and BTC,” he wrote. “I will make sure the U.S. is the Crypto Capital of the World. MAKING AMERICA GREAT AGAIN!”

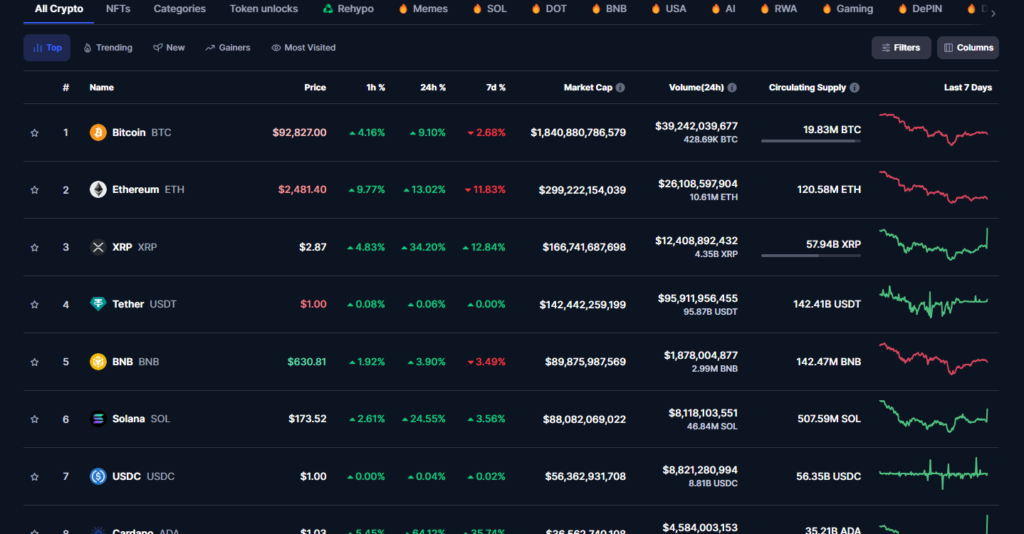

The reaction was instantaneous. Within an hour, XRP soared from $2.30 to $2.91 (a 36% spike), SOL climbed from $140 to $172 (24%), ADA rocketed from $0.60 to $1 (46%), and even Bitcoin, the granddaddy of crypto, jumped from $85,000 to $90,000 (6% but a massive $5,000 move). Posts on X captured the pandemonium: “Trump just dropped a nuke on the market—ADA up 30% in an hour!” one user exclaimed. The sentiment? Euphoric disbelief.

Why This Matters😎

Trump’s pivot to crypto isn’t just rhetoric—it’s a policy shift with teeth. After a campaign that wooed the crypto community with promises of deregulation and a Bitcoin reserve, this inclusion of altcoins like XRP, SOL, and ADA signals a broader embrace of digital assets. It’s a stark reversal from the Biden era’s regulatory crackdowns, which saw prices slump as low as $79,000 for BTC last week amid tariff fears and meme coin scandals. Now, with Trump’s backing, the narrative has flipped: America isn’t just playing catch-up—it’s aiming to dominate.

The market cap of crypto leaped from $2.7 trillion to over $2.9 trillion in hours, erasing losses since Trump’s November election win. This isn’t just hype; it’s a lifeline for an industry battered by uncertainty. But let’s get technical—how did this spike happen, and where’s it headed?

Technical Breakdown: The Surge Explained

- XRP ($2.91, +36% in 1 Hour):

- Before: XRP was languishing below its 23.6% Fibonacci retracement ($2.40), a key support lost during last week’s crash.

- Now: It smashed through this level and hit $2.61, with trading volume spiking 300% on exchanges like Binance. The Relative Strength Index (RSI) jumped from 40 (neutral) to 65 (nearing overbought).

- Why: Ripple, a U.S.-based company, benefits directly from Trump’s “America First” crypto push, boosting investor confidence.

- Solana (SOL, $172, +24%):

- Before: SOL had dipped to $1256 (its September low) amid bearish sentiment from a meme coin rug pull.

- Now: It reclaimed $160, surpassing its 50-day moving average ($155), with a 200% volume surge. RSI sits at 60, suggesting room to run.

- Why: Solana’s U.S. roots and scalability make it a darling of this reserve plan.

- Cardano (ADA, $1, +46%):

- Before: ADA was rejected at its descending trendline ($0.70) and hovered near $0.60.

- Now: It blasted past $0.80, with a 400% volume spike and RSI at 70 (overbought but with momentum).

- Why: Cardano’s eco-friendly proof-of-stake tech aligns with forward-thinking policy bets.

- Bitcoin (BTC, $91,000, +7%):

- Before: BTC was testing support at $85,000, with active addresses dropping—a classic capitulation signal.

- Now: It punched through $88,000 resistance, hitting $90,000, with RSI at 58 and volume up 150%.

- Why: Even without a direct mention, BTC rides the wave as the crypto kingpin.

The Rebound Context

This surge comes after a brutal February. Bitcoin had plummeted from its January 20 peak of $109,114 (Trump’s inauguration day) to $79,000 by February 27, a 27% drop, driven by tariff threats and a $1 billion ETF outflow. Altcoins like XRP, SOL, and ADA followed suit, shedding 20-30%. Sentiment was bleak—until Trump’s announcement flipped the script. Posts on X noted a “capitulation moment” turning into a “bullish reversal,” with active addresses spiking again.

Growth Potential: How High Can It Go?

The million-dollar question (or $100,000 BTC question): how much more can these cryptos grow? Let’s speculate with data:

- XRP:

- Next Target: $3.00 (38.2% Fibonacci, a 15% jump from here).

- Bull Case: If Trump’s summit on March 7 clarifies Ripple’s role, $5 (its 2021 high) isn’t crazy—a 90% upside.

- Risk: Overbought RSI could trigger a pullback to $2.40.

- Solana:

- Next Target: $180 (200-day moving average, +12%).

- Bull Case: SOL’s past rallies hit $260 (2021); with reserve backing, $200 (+25%) is plausible.

- Risk: Meme coin fallout lingers; $140 support must hold.

- Cardano:

- Next Target: $1.00 (psychological resistance, +15%).

- Bull Case: ADA’s 2021 peak was $3.10; a 50% reserve-driven push to $1.30 isn’t wild.

- Risk: RSI at 70 screams caution—$0.70 could retest.

- Bitcoin:

- Next Target: $95,000 (50% Fibonacci, +5%).

- Bull Case: Historical post-election pumps and reserve hype could drive BTC to $120,000 (+33%) by Q2.

- Risk: Tariffs or Fed rate hikes could cap it at $100,000.

Market-Wide: Analysts suggest a $3.5 trillion market cap (20% more) by April if regulatory clarity follows Trump’s March 7 Crypto Summit. A Federal Reserve rate cut (rumored for Q2) could turbocharge this to $4 trillion—a 40% total upside.

The Bigger Picture

This isn’t just a pump—it’s a paradigm shift. Trump’s reserve ties crypto to national strategy, potentially shielding it from dollar strength (index at 107.30) or trade wars. X posts buzz with “America’s crypto renaissance,” and for once, the hype might match reality. But volatility looms: overbought signals and profit-taking could cool things by mid-week.

Solana $SOL – Most of the Altcoins and memecoins are fueled on the Solana chain. So, the spike in Solana prices will lead to a bigger growth in the crypto prices of the altcoins

For now, the market dances to Trump’s tune. Whether you’re a trader riding the 20-50% spike or a hodler dreaming of six-figure BTC, one thing’s clear: the crypto winter just thawed into a blazing spring. How high can it climb? Strap in—the charts say we’re only getting started.

Read more updates and articles on our Crypto category page

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.