ULIP vs Term Insurance: Which One Fits Your Financial Goals Better?

When it comes to securing your future and protecting your family, life insurance is a must. But should you opt for a ULIP (Unit Linked Insurance Plan) or Term Insurance? Let’s break down both and help you decide what works best based on your goals and risk appetite – ULIP vs Term Insurance.

What Is Term Insurance?

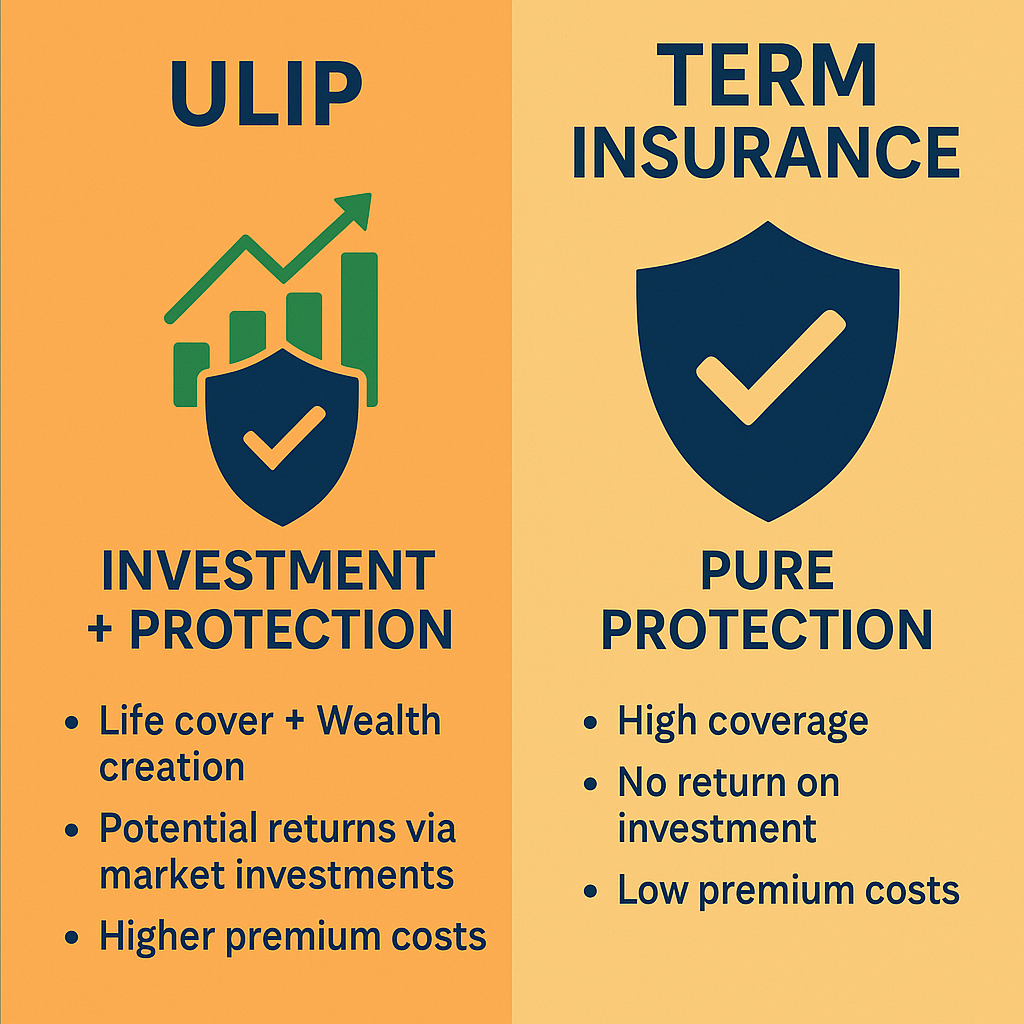

Term Insurance is a pure protection plan. You pay a small premium for a large sum assured. If the policyholder passes away during the term, the nominee receives the death benefit. If you survive the policy term, there are no maturity benefits.

- ✅ Affordable premiums

- ✅ High coverage

- ❌ No return on investment

- ✅ Best for: Breadwinners & family protection

What Is ULIP?

ULIP (Unit Linked Insurance Plan) combines insurance with market-linked investment. A part of your premium goes toward life cover, while the rest is invested in equity, debt, or hybrid funds based on your choice.

- ✅ Life cover + wealth creation

- ✅ Potential returns via market investments

- ❌ Higher premium costs

- ✅ Best for: Long-term investors & goal-based savers

Key Differences at a Glance:

| Feature | Term Insurance | ULIP |

|---|---|---|

| Coverage Type | Pure life cover | Life cover + Investment |

| Premium | Low | High |

| Maturity Benefits | None | Fund value payable |

| Investment Risk | None | Subject to market risk |

| Flexibility | Limited | Can switch between funds |

| Returns | Not applicable | Market-linked |

| Tax Benefits | 80C & 10(10D) | 80C & 10(10D) |

How to Choose the Right One?

- Choose Term Insurance if your goal is financial protection for your family at a low cost.

- Choose ULIP if you want to grow wealth over time while still having insurance coverage.

If you’re young and financially stable, starting with a ULIP may build long-term corpus. If you have dependents and need a safety net, term insurance offers peace of mind without breaking the bank.

Final Verdict:

Both have their purpose — Term Insurance protects, while ULIP helps you invest. The best choice depends on whether you’re focused on pure security or returns with risk. So select wisely between ULIP vs Term Insurance.

Check out more article on Finance on our Finance Category section.

#ULIP #TermInsurance #LifeInsurance #FinancialPlanning #InsuranceTips #InvestmentPlans #ULIPvsTerm #MoneyMatters #InsuranceGuide