ITR Filing 2025: Top 7 Essential Tips Salaried Taxpayers Must Know Before Submitting Returns

ITR 2025 Filing Guide: 7 Things Salaried Individuals Must Know

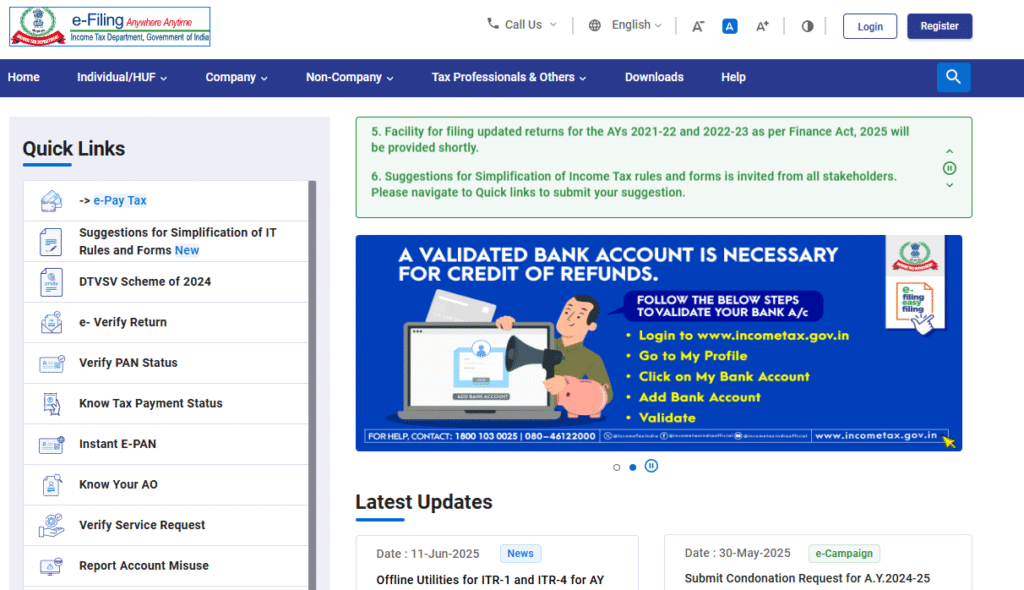

Income Tax Return filing: The ITR season for AY 2025-26 is here, and salaried taxpayers across India are gearing up to file their income tax returns. Whether you’re a seasoned taxpayer or filing for the first time, avoiding mistakes and maximizing tax benefits begins with understanding key processes and requirements.

Here’s your go-to checklist of the 7 most important things salaried individuals must consider before filing ITR 2025.

1. Choose the Right Tax Regime

India currently allows individuals to select between the old and new tax regimes:

- The old regime offers various deductions (like 80C, 80D, HRA, etc.).

- The new regime has lower tax rates but fewer deductions.

Important: You must inform your employer in advance if you wish to opt for the old regime—otherwise, the new regime will be applied by default. Use a tax calculator to evaluate which option suits your income and investment profile best.

2. Form 16 Is Crucial

Form 16 is a certificate issued by your employer showing:

- Your total salary

- Tax deducted at source (TDS)

It is a foundational document for filing ITR, so ensure you receive it before beginning the process.

3. Cross-Verify TDS with Form 26AS

Always match the TDS details in your Form 16 with Form 26AS, a consolidated tax credit statement on the income tax portal. It reflects:

- TDS from salary

- Interest on savings and FDs

- Any advance/self-assessment tax

Discrepancies can delay processing or trigger tax notices, so verification is key.

4. Don’t Confuse Investment with Tax Saving

Just because an investment doesn’t give you a tax break under the new regime doesn’t mean it’s not worthwhile.

Consider options like:

- Public Provident Fund (PPF)

- Sukanya Samriddhi Yojana (SSY)

- National Savings Certificate (NSC)

These can contribute significantly to long-term wealth creation even without immediate tax deductions.

🏠5. Understand HRA Exemption

If you’re eligible for House Rent Allowance (HRA) and can claim significant exemption, the old tax regime might offer better benefits. If not, the simplified structure of the new regime could be advantageous.

📈 6. Know When to File ITR-2 Instead of ITR-1

Most salaried individuals use ITR-1, but not always.

Use ITR-2 if:

- You earn capital gains (e.g., from stocks)

- Your income exceeds ₹50 lakh

- You own more than one property

- You have foreign assets or income

Filing the wrong ITR form may lead to return rejection.

🏘️ 7. Rental Income from Multiple Properties? File ITR-2

If you own and earn from only one house property, you can file ITR-1. However, if you have two or more properties with rental income, ITR-2 is mandatory.

Other Pro Tips:

🔗 Link Aadhaar with PAN

Make sure your Aadhaar is linked to your PAN. An unlinked PAN is considered inoperative and will prevent ITR filing.

📁 Keep All Docs Handy

Collect:

- Form 16

- Form 26AS

- Annual Information Statement (AIS)

- Bank statements

- Deduction proofs (80C, 80D)

✅ Verify Your Return After Filing

Post submission, e-verify your return using Aadhaar OTP, internet banking, or by sending a signed ITR-V to CPC Bengaluru. Without verification, your ITR is incomplete.

Final Thoughts

Filing ITR can feel overwhelming, but a structured approach makes it manageable—and even rewarding. Being proactive, knowing which form to file, selecting the right tax regime, and gathering documents in advance helps you stay compliant while optimizing your tax outcomes for the Income Tax Return filing.

Don’t wait till the last day. Start now to file stress-free.

Got questions? Drop them below—I’m all ears!

Also, read our other article EPF Interest Rate for FY25 Stays at 8.25%: How Much You’ll Earn & When It Gets Credited

Check out more article on Finance on our Finance Category section.

#ITR2025 #IncomeTaxReturn #Form16 #Form26AS #TaxFilingTips #SalariedTaxpayer #OldVsNewRegime #TaxDeductions