U.S. Stocks to Watch Over the Next 6 Months — Simplified Guide + Top Picks

Looking to invest in U.S. stocks over the near term (next six months)? Here’s a straight-forward, no-jargon guide on which sectors look promising, why they matter right now, and three specific stock picks you might consider—along with what to watch. (US stocks next 6 months)

🔍 Sectors to Focus On

1. Technology / AI Ecosystem

- Why: The tech sector continues to be the engine of growth. The technology sector has massive scale and strong earnings momentum.

- What to watch: major chip makers, cloud & AI infrastructure firms, software firms with recurring revenue.

- Primary risk: High valuations; if earnings disappoint or macro headwinds hit, correction risk rises.

2. Financials & Financial Services

- Why: With changing interest rate dynamics and digital finance growth, financials could benefit.

- What to watch: Banks’ net interest margins, loan-loss provisions, fintech disruptors.

- Primary risk: Economic slowdown affecting credit quality; regulatory/policy shifts.

3. Clean Energy / Infrastructure / Utilities

- Why: Strong structural tailwinds (energy transition, infrastructure rebuild). INDmoney+1

- What to watch: Renewable energy firms, infrastructure play-outs, utilities benefiting from data-centre/AI expansion.

- Primary risk: Capital-intensive business, policy/regulation risk, interest-rate sensitivity.

✅ Top 3 Stock Picks to Consider

Here are three U.S. stocks, each aligned with one of the sectors above. (Note: Not a recommendation—do your own research.)

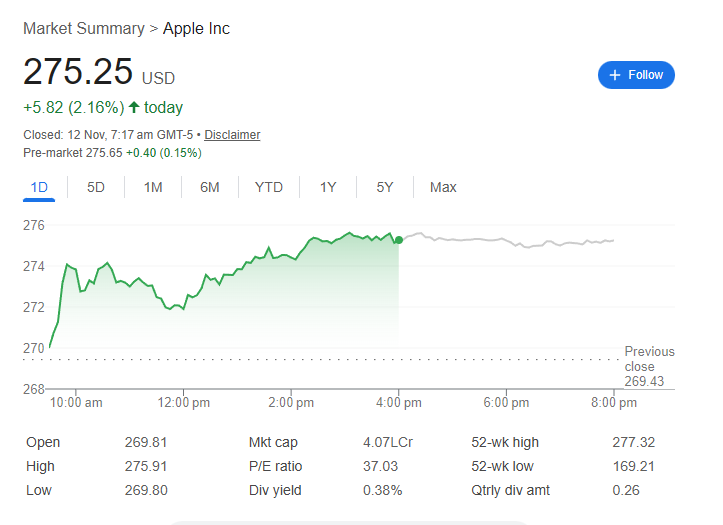

- Apple Inc. (Ticker: AAPL) — Tech & services juggernaut. Solid balance sheet, strong ecosystem, recurring revenue.

- JPMorgan Chase & Co. (Ticker: JPM) — Leading financial institution; stands to benefit if interest rates stay favourable and economy holds up.

- NextEra Energy, Inc. (Ticker: NEE) — Large U.S. clean-energy operator; well placed for energy transition/infrastructure tailwinds.

🧩 How to Use This in Your Portfolio

- Allocate wisely: Don’t put everything into one sector. Spread exposure across the three themes.

- Entry strategy: Look for pull-backs or corrections to enter rather than chasing highs.

- Watch metrics: Especially earnings, valuation (P/E), policy/regulation indicators, macro signals (inflation, rates).

- Time horizon: Six months is short in investing terms. Expect market noise; be prepared for fluctuations.

- Exit plan: Have a clear idea when you’ll review your positions or take profits if things go well.

⚠️ Major Risks to Keep in Mind

- Overly high valuations in many tech names might lead to sharp corrections if earnings don’t meet expectations.

- If the economy weakens or inflation stays sticky, financial stocks may suffer, and risk of broader market pull-back rises.

- Clean-energy / infrastructure plays can be hit by regulatory changes, policy reversals, or interest-rate hikes affecting cost of capital.

- Broad market sentiment can shift quickly—sector leaders today may lag tomorrow.

US stocks next 6 months

Read more updates and articles on our Finance category page and also for Bitcoin price Forecast. Also, read our article on – Wall Street’s Wake-Up Call: Inside the November 2025 Stock Market Crash