Silver Hits All-Time High… Then Slips: What’s Next for Silver in 2026?

Silver just pulled off a classic market drama. First, it soared to record highs, grabbing headlines and investor attention everywhere. Then — almost on cue — it cooled off sharply, shaking out weak hands and sparking one big question: 👉 Is silver’s rally over… or is this just a pit stop before the next big move? (silver outlook 2026)

Let’s break it down — simply, clearly, and with a forward-looking lens.

When Silver Touched the Sky

Silver’s rally wasn’t random hype.

It was powered by a perfect storm of fundamentals:

- Rising industrial demand from solar panels, EVs, and electronics

- Safe-haven buying amid global uncertainty

- Expectations of lower interest rates, which tend to favor precious metals

Prices surged so fast that silver hit all-time highs globally and in India, outperforming even gold for a while.

Momentum traders piled in. Long-term investors smiled.

Then came reality.

Why Did Silver Crash After Hitting Highs?

Silver didn’t fall because the story broke — it fell because markets needed to breathe.

Here’s what triggered the dip:

Profit Booking

After a sharp vertical rise, traders locked in gains. Totally normal.

Overheated Charts

Silver is known for wild swings. When it moves up fast, corrections tend to be equally dramatic.

Short-Term Risk-On Mood

As equity markets stabilized, some safe-haven money rotated out of metals.

Important point 👉

This was a correction, not a collapse.

The long-term drivers are still alive.

Silver Outlook for 2026: Cautiously Bullish, Wildly Volatile

Silver’s future looks promising — but not smooth.

🌟 Why 2026 Could Be Strong for Silver

Industrial Demand Is Structural

Silver isn’t just a “store of value.” It’s a critical industrial metal. Green energy alone consumes massive amounts of silver every year — and that demand isn’t slowing.

Limited Supply Growth

New silver mining supply is constrained. When demand rises faster than supply, prices feel the pressure.

Macro Tailwinds

Lower global interest rates, inflation hedging, and currency uncertainty all favor precious metals.

Many long-term models suggest higher price zones for silver by 2026, though the path will likely be bumpy.

What Could Go Wrong?

Silver is not for the faint-hearted.

- Sharp corrections can happen anytime

- Prices react quickly to global sentiment

- It often moves more violently than gold

Bottom line:

📌 Silver rewards patience — and punishes over-leverage.

How to Invest in Silver in India

Indian investors have multiple ways to ride the silver story — depending on risk appetite for silver outlook 2026.

1. Physical Silver (Coins & Bars)

The most traditional route.

Best for: Long-term holders, conservative investors

Watch out for: Making charges, storage, liquidity

2. Silver Futures (MCX)

For traders who understand volatility.

Pros: High liquidity, leverage

Cons: High risk, margin requirements

Not beginner-friendly — but powerful in skilled hands.

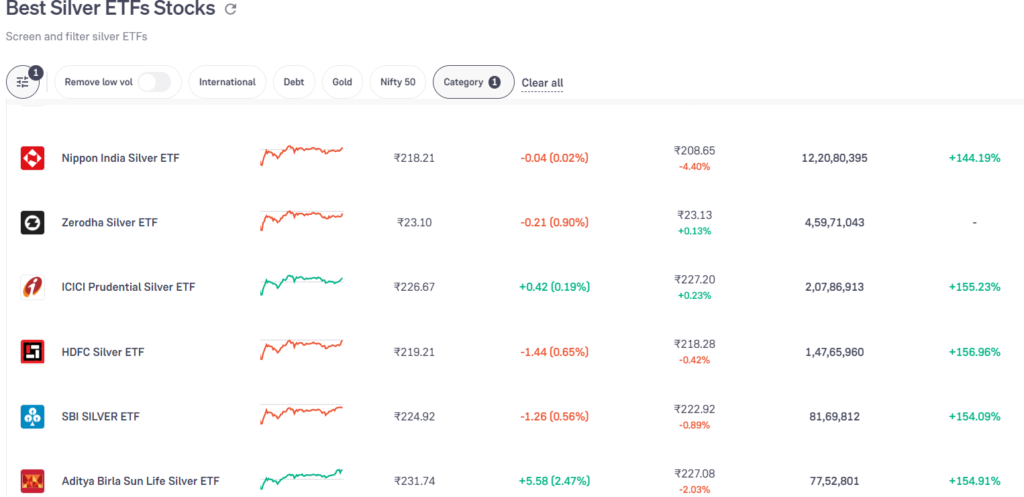

3. Silver ETFs

One of the cleanest and simplest options.

- Tracks silver prices

- No storage issues

- Easy to buy/sell via demat account

Ideal for investors who want exposure without the hassle.

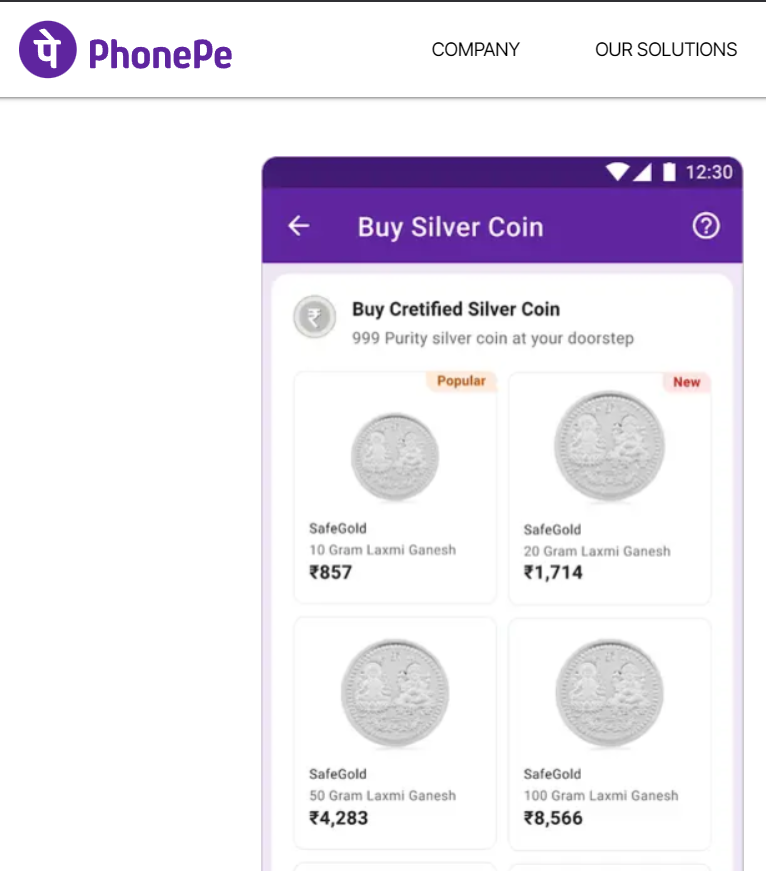

4. Digital Silver

Buy small quantities online, store digitally, redeem later.

Good for: First-time investors, small ticket sizes

Limitation: Long-term trust depends on platform credibility

🧠 Smart Strategy for 2026

Instead of asking “Will silver go up?”, ask:

– Am I investing or trading?

– Can I handle volatility?

– Does silver fit my overall portfolio?

Pro tip:

🟢 Accumulate on dips

🔴 Avoid chasing all-time highs

⚖️ Keep silver as a portion of your portfolio, not the whole thing

✨ Final Take

Silver’s recent crash doesn’t kill the bull case.

It resets it.

For 2026, silver remains one of the most exciting — and volatile — assets out there. If you respect its swings and invest with discipline, silver could shine again.

Just remember:

📉 Short-term chaos

📈 Long-term potential

That’s silver.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making investment decisions.

Read more updates and articles on our Crypto category page

#SilverPrice #PreciousMetals #SilverInvestment #InvestingIndia #Commodities #MarketTrends #WealthBuilding

Silver price today, silver all time high, silver price crash, silver outlook 2026, invest in silver India, silver ETFs India, MCX silver, digital silver, precious metals investment